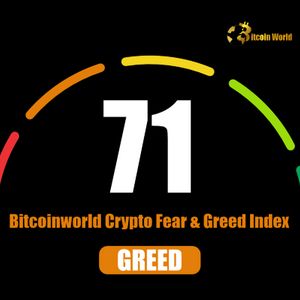

Unveiling Crypto Fear and Greed Index: What 71 Means for Market Sentiment

5 min read

BitcoinWorld Unveiling Crypto Fear and Greed Index: What 71 Means for Market Sentiment Ever wondered what the collective mood of the cryptocurrency market is? Are investors feeling bullish and ready to buy, or are they panicking and looking to sell? That’s where tools like the Crypto Fear and Greed Index come in handy. It attempts to gauge the prevailing emotion driving the market, providing a snapshot of crypto market sentiment . As of June 12th, this index, provided by Alternative, registered a value of 71. While this is a slight dip of one point from the previous day, it firmly keeps the market mood anchored in the ‘Greed’ zone. Understanding the Crypto Fear and Greed Index So, what exactly is this index and why does it matter? The Crypto Fear and Greed Index is a simple yet insightful tool designed to visualize the two primary emotions that often influence investor behavior: fear and greed. In volatile markets like crypto, these emotions can be amplified, leading to irrational decisions. Here’s a quick breakdown of the index scale: 0-24: Extreme Fear – This indicates significant panic in the market. Investors are likely selling off assets, often irrationally. This could potentially be a buying opportunity for brave contrarians. 25-49: Fear – Sentiment is still cautious or negative. Many investors are hesitant to buy. 50: Neutral – The market is balanced, with no strong leaning towards fear or greed. 51-74: Greed – This suggests investors are becoming overly optimistic and potentially overpaying for assets. While prices may still rise, this zone can signal increasing risk. 75-100: Extreme Greed – The market is likely experiencing a bubble-like euphoria. Prices may be unsustainably high, and a correction could be imminent. This is often considered a dangerous time to buy and potentially a good time to consider selling. A reading of 71, as we see now, places the market squarely in the ‘Greed’ category. This means that despite a slight pullback in sentiment from the day before, the overall mood is one of optimism and bullishness among market participants. Decoding Crypto Market Sentiment: What Factors Influence the Index? The Crypto Fear and Greed Index isn’t just a random number. It’s calculated using a weighted average of several different data points, aiming to capture various aspects of crypto market sentiment . Understanding these factors helps provide a more complete picture: Volatility (25%): This measures the current volatility and maximum drawdown of Bitcoin compared to its average corresponding values over the last 30 and 90 days. Higher volatility in a positive direction can indicate bullishness, while sharp drops signal fear. Market Momentum/Volume (25%): This component looks at the current volume and market momentum compared to the average values of the last 30 and 90 days. High buying volume and strong positive momentum suggest greed is increasing. Social Media (15%): This factor analyzes posts on social media platforms (specifically Twitter, according to Alternative) to gauge how many different posts mention Bitcoin and how fast they are being posted. A high level of interaction and positive sentiment mentions can point towards growing greed. Surveys (15%): This factor is currently paused, but historically it involved weekly crypto polls to get a direct sense of investor sentiment. Bitcoin Dominance (10%): This metric tracks the market capitalization share of Bitcoin relative to the total market cap of all cryptocurrencies. An increasing Bitcoin dominance can indicate that investors are moving funds out of altcoins and into the perceived safety of Bitcoin, which can sometimes signal caution or fear in the broader altcoin market, or simply strong confidence in Bitcoin itself, depending on the context. Google Trends (10%): This analyzes search queries related to Bitcoin on Google Trends. A sudden surge in searches for terms like “Bitcoin price manipulation” might indicate fear, while increased searches for “buy Bitcoin” could suggest growing greed. Each of these factors contributes to the final index score, providing a multi-faceted view of the market’s emotional state. While surveys are currently paused, the other five factors continue to feed into the calculation. Navigating the Greed Zone: What Does 71 Imply? A reading of 71 means the market is feeling optimistic. Prices have likely seen significant positive movement recently, attracting more buyers and generating positive buzz on crypto social media . The strong crypto market momentum contributes significantly to this score. However, it’s crucial to remember what the index represents. It’s a sentiment indicator, not a crystal ball or a direct buy/sell signal. Historically, periods of ‘Extreme Greed’ have often preceded market corrections, as excessive optimism can lead to inflated asset prices. Conversely, times of ‘Extreme Fear’ have sometimes marked market bottoms, offering potential buying opportunities. Being in the ‘Greed’ zone suggests caution might be warranted. While the rally could continue, the risk of a downturn increases as sentiment becomes overly positive. It implies that many market participants are expecting prices to keep rising, which can sometimes lead to speculative bubbles. Actionable Insights: Using the Index Wisely So, how should you use this information? Here are a few actionable insights: Use it as a Contra-Indicator (with caution): Some experienced traders use the index as a contra-indicator. When the index is showing ‘Extreme Greed’, they might consider reducing exposure or taking profits. When it shows ‘Extreme Fear’, they might look for potential buying opportunities. However, this strategy is risky and requires careful consideration and other analysis. Gauge Market Psychology: The index is excellent for understanding the general emotional climate. Are people euphoric or panicking? This context can help you evaluate news and price movements. Combine with Other Analysis: Never rely solely on the Fear & Greed Index. Use it alongside fundamental analysis (understanding the technology, use case, and team behind a project), technical analysis (studying price charts and patterns), and your own risk management strategy. Avoid Emotional Decisions: The index highlights how emotions drive the market. Seeing ‘Greed’ might make you want to jump in, or ‘Fear’ might make you want to sell everything. Use the index as a reminder to stick to your pre-defined investment plan rather than making impulsive decisions based on current sentiment. The fact that the index slightly decreased from 72 to 71 could suggest a minor cooling off or sideways movement in sentiment, but it’s not a significant shift out of the optimistic territory. The overall message remains: the market is currently operating with a high degree of positive sentiment. Conclusion: A Pulse Check on Crypto Emotions The Crypto Fear and Greed Index is a valuable tool for taking the pulse of the market’s emotional state. Its current reading of 71 firmly places us in the ‘Greed’ zone, reflecting the strong crypto market momentum , positive chatter on crypto social media , and overall optimism driven by factors like volatility and Bitcoin dominance trends. While this indicates bullish sentiment, it also serves as a reminder that markets driven by high levels of greed can be susceptible to corrections. Use the index as one piece of your analysis puzzle, helping you understand the prevailing psychological winds, but always combine it with thorough research and a disciplined investment approach. It’s not a guarantee of future price movements, but a fascinating look into the collective mind of crypto investors right now. To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency price action. This post Unveiling Crypto Fear and Greed Index: What 71 Means for Market Sentiment first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World