ETH Bulls Tighten Grip as $393M Exits Exchanges and ETF Inflows Outpace Bitcoin

2 min read

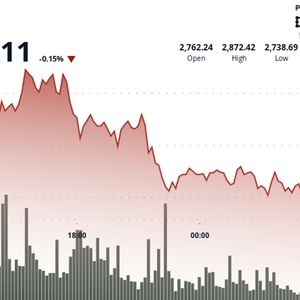

Ether( ETH) ETH struggled to maintain Tuesday’s momentum, falling 0.15% to $2,758 amid selling pressure that emerged during U.S. afternoon trading on June 11. The pullback followed a brief rally to $2,872.42, which proved unsustainable as price action reversed sharply between 15:00 and 17:00 UTC, according to CoinDesk Research’s technical analysis model. The late-session sell-off intensified in early Asia hours, punctuated by a 1.29% dip from $2,772 to $2,736 on heavy volume, before ether rebounded slightly toward $2,758 at press time. Despite the downturn, key metrics suggest rising conviction among bulls. Glassnode reported that options skew flipped sharply negative over the past 48 hours—one-week skew dropping from –2.4% to –7.0% — indicating increased demand for short-dated calls. Put-call ratios remain heavily tilted toward upside exposure, with open interest and volume ratios holding near multi-week lows. On-chain flows also reinforced the bullish bias. Analytics firm Sentora (formerly, IntoTheBlock) flagged that over 140,000 ETH, worth approximately $393 million, was withdrawn from exchanges on June 11 — the largest single-day outflow in more than a month. Simultaneously, ETH-based ETFs extended their inflow streak with another $240.3 million added Wednesday, surpassing the day’s Bitcoin ETF totals. Analyst Anthony Sassano noted that Ethereum has avoided a single net outflow day since mid-May, calling the trend “accelerating” and arguing that the asset remains structurally undervalued. While price action shows short-term weakness, market positioning and capital flows suggest traders may be buying the dip in anticipation of another upside attempt. Technical Analysis Highlights ETH traded within a $139 range between $2,733 and $2,872 before closing at $2,758. Heavy selling emerged near $2,870–$2,880 during June 11’s late U.S. session. Support near $2,745–$2,755 was breached after multiple tests, triggering a quick declineVolume spiked above 34,000 ETH during a rapid drop from $2,772 to $2,736 early June 12. A temporary bounce toward $2,752 failed, and a new support zone may be forming near $2,735 Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk