Arthur Hayes Predicts Bitcoin Surge If Bank of Japan Eases Policy

2 min read

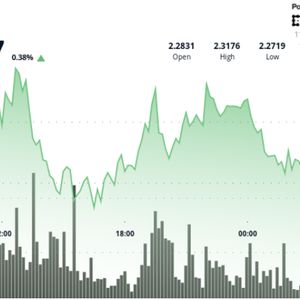

The post Arthur Hayes Predicts Bitcoin Surge If Bank of Japan Eases Policy appeared first on Coinpedia Fintech News Arthur Hayes, the former CEO of crypto exchange BitMEX, suggested that if Japan’s top bank, the Bank of Japan (BoJ), decides to boost the economy by printing more money instead of trying to slow down rising prices, it might set Bitcoin and Ethereum up for a big jump. Let’s see why! BoJ’s Big Decision on June 17th For a long time, the BoJ has been strict, saying that inflation is still above where they’d like it to be. But with the central bank’s next big meeting coming up on June 17th , Hayes sees a chance for a different approach. He believes that if the BoJ stops tightening its money policy and goes back to helping the economy by printing more money (quantitative easing, or QE), then Bitcoin could surge higher. This isn’t just about Bitcoin. Hayes pointed out that while some people in Japan might not like the idea of easier money, it could mean good news for risky assets in general. What’s Going on in Japan? Japan has been known for keeping its interest rates low for a long time compared to other countries like the U.S. and Europe. This helps families and companies borrow money easily, but it also makes Japan’s money, the yen, weaker. A weaker yen means that things that Japan buys from other countries get more expensive. Bank of Japan Governor Kazuo Ueda has hinted that they’re not rushing to tighten money conditions, which could continue until 2026. Since other big central banks, like the U.S. Federal Reserve, have been raising rates, Japan’s slow pace of change is giving investors a chance to borrow yen at lower costs. Many see this as a way to invest in cryptocurrencies like Bitcoin, which is seen as a safer haven during inflation. Money Flowing Into Bitcoin If Japan decides to change its money policy, it could trigger another big pump in crypto. Even Standard Chartered has updated its earlier forecast for Bitcoin, predicting it will now reach $200,000 by the end of 2025, up from $120,000 in Q2. This growing confidence is also reflected in the huge Bitcoin ETF inflows, which saw a fresh inflow of $386.2 million . As of now, Bitcoin is trading around $109,487, up 2.5% in the last 24 hours, with a market cap of $2.18 trillion.

Source: coinpedia