Why every smart trader is watching MUTM before it hits $0.10

4 min read

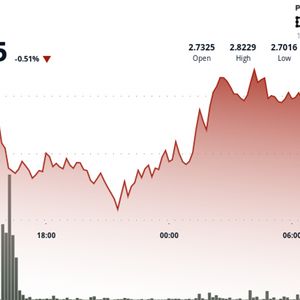

In crypto, some of the biggest opportunities come before a token hits public markets. Utility-based projects with working products, audited smart contracts, and structured presales often create the perfect entry point for early traders. That’s exactly what is happening with Mutuum Finance (MUTM) , which is currently priced at $0.03 in Phase 5 of its presale. So far, the project has raised over $10 million and attracted more than 11,800 holders — and interest continues to build as the price edges toward $0.10. Mutuum Finance (MUTM) is preparing to launch the beta version of its platform by the time the token goes live. That means utility is not months away — it’s right around the corner. For traders who understand how value builds around usable DeFi tools, this is a strong signal. Utility comes first, hype follows Unlike many tokens that rely on speculation, Mutuum Finance (MUTM) is designed around real usage. The platform enables decentralized lending and borrowing through both Peer-to-Contract (P2C) and Peer-to-Peer (P2P) models. The P2C system allows users to deposit into a shared pool and earn interest based on supply and demand. The P2P model gives users more control, letting them lend directly to other users while setting their own terms. One of the unique advantages of Mutuum’s P2P model is that it supports tokens not typically available in traditional platforms. Traders can lend and borrow assets like PEPE, DOGE, or SHIB — memecoins that usually get ignored by larger DeFi protocols. This flexibility is attracting interest from users who want to unlock liquidity from the tokens they actually hold. CertiK audit adds confidence Security matters in decentralized finance. That’s why traders are paying attention to the recent CertiK audit of Mutuum Finance (MUTM). The audit included both static analysis and a manual review, and the project received a token scan score of 80. For investors evaluating the safety of their capital, this independent verification adds a level of credibility that many early-stage projects lack. When smart money gets involved early, it often looks for projects that pair technical development with security milestones. Mutuum Finance (MUTM) has both. MUTM is designed to reward holders The utility of the MUTM token goes far beyond speculation. It plays an active role within the platform. When users deposit assets into the protocol, they receive mtTokens that reflect both their deposit and any earned interest. These mtTokens can be staked to earn passive dividends from the protocol’s revenue. The dividend system works by taking a portion of platform income to buy MUTM tokens from the market. These are then distributed to users who stake their mtTokens. This model rewards long-term participation and directly links token demand to platform activity. As the platform grows, demand for MUTM is expected to grow alongside it. Layer-2 infrastructure improves the user experience One of the most important technical upgrades in progress is the integration of Layer-2 solutions. By building on Layer-2, Mutuum Finance (MUTM) will reduce transaction costs and improve speed. This is a direct response to common issues in DeFi such as network congestion and gas fees, and it puts Mutuum in a stronger position to scale efficiently. This infrastructure choice matters. It’s the kind of detail that experienced traders look for when evaluating a project’s ability to survive and grow in a competitive space. A Stablecoin that works for the ecosystem Another key development is Mutuum’s upcoming overcollateralized stablecoin. Unlike fiat-backed stablecoins, this one will be fully supported by assets already deposited in the protocol. It will be minted on-chain, with automatic supply adjustments and full transparency. Interest from stablecoin borrowing will be recycled into the system, strengthening treasury reserves and adding sustainability to the entire protocol. At the same time, it creates another reason to use and hold MUTM, since the ecosystem is built to feed value back to users. Real trading patterns back the buzz A look at trader behavior shows what’s happening under the surface. Early utility tokens often build quiet momentum in presale stages. Once the platform launches and listings begin, price movement tends to accelerate. That’s why many experienced traders are positioning now, while the price remains under $0.05. Mutuum Finance (MUTM) is following this path closely. It has a structured presale, a public beta planned for launch, a CertiK audit already complete, and a long-term model for sustainable growth. The fundamentals are in place, and the $100,000 giveaway is helping expand its reach even further. Final thought Every cycle, some of the best-performing projects are the ones with strong utility, clear roadmaps, and limited early access. Mutuum Finance (MUTM) checks all of these boxes. With the beta release approaching, the presale progressing quickly, and the price still well under $0.10, it’s easy to see why so many traders are watching this project closely. For more information about Mutuum Finance (MUTM) visit the links below: Website: https://mutuum.com/ Linktree: https://linktr.ee/mutuumfinance The post Why every smart trader is watching MUTM before it hits $0.10 appeared first on Invezz

Source: Invezz