Binance Announces Listing of a New Altcoin Trading Pair with 50x Leverage on Futures Platform! Here Are the Details

2 min read

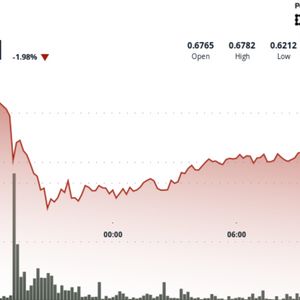

Binance Futures has announced the launch of a new USDⓈ-margined perpetual contract for LA/USDT, set to go live on June 5, 2025 at 12:00 UTC. The move is part of Binance’s efforts to diversify trading options and enhance user experience on its futures platform. Binance Futures to Launch LA/USDT Perpetual Contract with Up to 50x Leverage on June 5 Basic Details of LA/USDT Perpetual Contract Launch Time: June 5, 2025, 12:00 Leverage: up to 50x Collateral Type: USDⓈ-Margined (settled in USDT) Funding Rate Cap: Initially ±2.00% Funding Interval: Every 4 hours The contract will also be available for Futures Copy Trading within 24 hours of launch, allowing users to follow and copy the trading strategies of top traders. For more information, see Binance’s Futures Copy Trading FAQ. Binance users can use Multi-Asset Mode to trade LA/USDT perpetual contracts using other assets such as BTC as collateral, subject to applicable fees. Binance noted that contract features may be adjusted based on market risk conditions. These adjustments may include changes to leverage limits, funding fees, collateral requirements, and confirmation sizes. The LA token is already listed on the Binance Alpha Marketplace and this new derivative offering aims to deepen market participation and liquidity for the token. The contract will be subject to Binance’s Terms of Use and Binance Futures Service Agreement. This latest addition reflects Binance Futures’ continued expansion of its derivatives ecosystem, offering users more strategic tools to manage market risk and capitalize on volatility in the crypto market. *This is not investment advice. Continue Reading: Binance Announces Listing of a New Altcoin Trading Pair with 50x Leverage on Futures Platform! Here Are the Details

Source: BitcoinSistemi