US Dollar Gains: Crucial Forex Trends Before ECB

4 min read

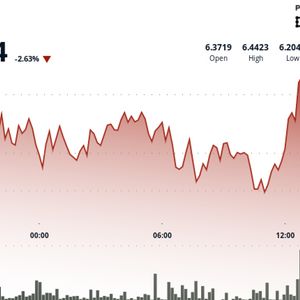

BitcoinWorld US Dollar Gains: Crucial Forex Trends Before ECB In the interconnected world of global finance, shifts in major currency pairs can send ripples across various markets, including digital assets. The recent slight gain in the US Dollar , pushing it up from a six-week low, alongside a noticeable slip in the Euro , highlights the dynamic nature of the Forex trends currently at play. These currency movements are particularly significant as markets anticipate a crucial ECB meeting . Why Did the US Dollar See a Slight Gain? The US Dollar had been trading at a six-week low against a basket of currencies, reflecting shifting market sentiment and expectations regarding the Federal Reserve’s future monetary policy. The recent modest rebound can be attributed to several factors: Data Releases: Incoming economic data from the United States might have offered a slightly more positive picture than some market participants expected, leading to a reassessment of the likelihood or timing of Fed rate cuts. Relative Central Bank Outlooks: Compared to expectations for other major central banks, particularly the European Central Bank (ECB), the outlook for the Fed might appear relatively less dovish in the immediate future. This divergence can support the US Dollar . Technical Factors: After reaching a notable low, technical trading patterns and short-covering could also contribute to a slight upward correction. Understanding these drivers is key to interpreting the broader Forex trends . The Euro’s Slip: All Eyes on the ECB Meeting Conversely, the Euro has experienced a dip. This weakening is largely tied to the impending ECB meeting . Markets are heavily focused on what signals the European Central Bank will send regarding its monetary policy stance. Expectations are building that the ECB might be closer to cutting interest rates than the U.S. Federal Reserve. This anticipated divergence in monetary policy between the two major economic blocs puts pressure on the Euro against the US Dollar . Key questions surrounding the ECB meeting include: Will the ECB signal an imminent rate cut? What will their commentary on inflation and economic growth indicate about the pace of future potential cuts? How will the ECB’s forward guidance compare to that of the Fed and other central banks? The answers from the ECB meeting will likely dictate the short-term trajectory for the Euro and significantly influence global currency movements . Broader Forex Trends and Currency Movements The dynamics between the US Dollar and the Euro are just one piece of the puzzle in the complex world of Forex trends . Other currencies are also reacting to their own domestic economic conditions, central bank policies, and global risk sentiment. Major factors influencing current Forex trends include: Inflation Data: Persistent inflation in various regions forces central banks to maintain tighter policies, while cooling inflation allows for potential easing. Economic Growth: Stronger growth outlooks generally support a country’s currency, attracting investment. Geopolitical Events: Global instability can increase demand for safe-haven currencies like the US Dollar . Commodity Prices: Currencies of commodity-exporting countries are often influenced by fluctuations in raw material prices. These interacting forces create constant currency movements , presenting both opportunities and challenges for market participants. Challenges and Volatility in Currency Markets Navigating the Forex market comes with inherent challenges: Unpredictable Data: Economic indicators can surprise markets, leading to sudden and sharp currency movements . Central Bank Communication: Central bank officials’ speeches and meeting minutes are scrutinized for subtle shifts in tone, which can be interpreted differently by market participants. The outcome of the ECB meeting is a prime example of such an event risk. Global Interconnectedness: Events in one part of the world can quickly impact currencies elsewhere, making it essential to monitor a wide range of information. Volatility means that while there are potential benefits from favorable Forex trends , there are also risks of rapid reversals. Actionable Insights for Market Watchers For those monitoring global markets, including the cryptocurrency space which can be indirectly affected by macro liquidity and sentiment, here are some actionable insights: Monitor Central Banks: Pay close attention to statements and decisions from the Federal Reserve and the ECB. The upcoming ECB meeting is a key event. Understand their differing mandates and economic outlooks. Track Key Data: Watch for inflation reports, employment figures, and GDP growth data from major economies like the U.S. and the Eurozone. These directly influence central bank actions and currency movements . Understand Divergence: The difference in expected monetary policy paths between central banks (like the Fed and the ECB) is a major driver of pairs like EUR/USD. Assess Risk Sentiment: During times of global uncertainty, the US Dollar often strengthens as a safe haven. Monitor geopolitical developments. While not directly trading Forex, understanding these underlying Forex trends provides valuable context for the broader financial environment. Summary: What These Currency Shifts Mean The slight gain in the US Dollar and the dip in the Euro are reflective of market positioning ahead of key central bank decisions, particularly the highly anticipated ECB meeting . These currency movements are part of larger global Forex trends driven by economic data, inflation expectations, and divergent monetary policy outlooks. While seemingly distant from the world of digital assets, the strength or weakness of major global currencies, and the factors driving them, contribute to the overall liquidity and risk appetite in the financial system. Staying informed about these macro shifts is a valuable part of understanding the broader market landscape. To learn more about the latest Forex market trends, explore our article on key developments shaping currency movements. This post US Dollar Gains: Crucial Forex Trends Before ECB first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World