Strategy: The Bitcoin-Treasury Flywheel Is Spinning Into Overdrive

6 min read

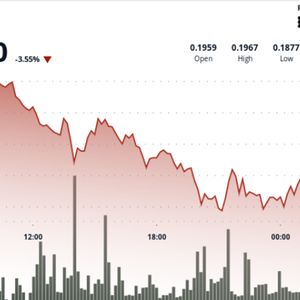

Summary MicroStrategy’s aggressive bitcoin accumulation, now over 580,000 BTC, transforms it into a leveraged, regulated ETF on digital scarcity with significant upside potential. Subscription software revenue is accelerating, driven by AI integration, supporting a dual-engine growth model of software and bitcoin appreciation. Capital-raising prowess enables ongoing bitcoin purchases, with dilution risks mitigated as long as bitcoin per share outpaces share growth. Despite headline valuation multiples, I see MSTR as undervalued for investors bullish on bitcoin and AI, with 50% upside over the cycle. Introduction MicroStrategy ( MSTR ) has spent the past four years transforming itself from a midsized business-intelligence vendor into the world’s largest publicly traded holder of bitcoin, and its first-quarter 2025 results show that the pivot is accelerating rather than stalling. During the quarter the company added 301,335 coins, lifting total holdings to 553,555 BTC and then, in early June, to 580,955 BTC at an average purchase price of roughly $70,000 per coin . At a spot price hovering near $105,000, that trove is worth about $61 billion, dwarfing MicroStrategy’s legacy software revenue base and anchoring a balance sheet that now looks more like a sovereign wealth fund than a traditional tech company. Yet, the software engine that once defined MicroStrategy still matters. Subscription services revenue jumped 62% year over year to $37 million even as total revenue slipped 3.6% to $111 million, indicating that the shift to cloud analytics is gaining traction in spite of headline volatility tied to digital-asset accounting. Management is plainly leaning into the model: a new $21 billion at-the-market equity program and $7.7 billion of gross capital raised in Q1 provide the financial firepower to keep buying bitcoin while incrementally funding R&D that embeds AI functionality into the firm’s analytics suite. Thesis AI is ushering in an age of digital abundance, driving down the marginal cost of knowledge work and tempting central banks to monetize faster productivity by expanding the money supply. As real yields compress, investors are seeking scarce, hard-coded stores of value. Bitcoin, with its fixed 21 million-coin cap, stands out as the only digital asset offering built-in monetary discipline. Against that backdrop, MicroStrategy’s decision to convert cash flows, balance-sheet liquidity and even fresh capital raises into bitcoin is radical but coherent: the company is effectively a leveraged, regulated ETF on a deflationary reserve asset, wrapped inside a still-profitable software vendor. The strategy gives shareholders two engines of compounding of organic software growth and externally financed bitcoin appreciation, each reinforcing the other in a world where AI lifts GDP but erodes the purchasing power of fiat savings. Strategy Bitcoin as Treasury Alpha MicroStrategy now controls approximately 2.8% of all bitcoin that will ever exist, compared with 0.9% just two years ago. Because the company capitalizes these purchases primarily through equity and convertible-debt issuance, the effective cost of carrying the position is the discount between its share price and intrinsic bitcoin value. With BTC at $105,000, MicroStrategy’s $101.8 billion market capitalization trades at a roughly 1.7x multiple of coin value, which is far below the 8x EV/revenue multiples that cloud-software peers command. This implies that investors are paying a modest premium for the embedded analytics franchise and future coin accretion. Equally important, MicroStrategy’s proprietary “BTC Yield” metric (bitcoin earned through active treasury management such as futures basis trades) reached 13.7% year-to-date, prompting management to lift its 2025 target to 25%. In effect, the company is monetizing financial expertise to compound holdings faster than simple buy-and-hold investors, creating a positive feedback loop: the more coins it owns, the more optionality it has to generate incremental yield without risking principal. Strategy Software Resilience in an AI-First Era While bitcoin dominates headlines, the core analytics platform is quietly re-accelerating. Subscription services revenue rose to $37.1 million, accounting for a record 33% of total sales, as enterprises adopt cloud-native versions of the MicroStrategy One platform to embed generative AI into dashboards and mobile workflows. Management highlighted new AI governance modules allowing customers to watermark LLM outputs and audit data lineage, differentiating the product in a crowded BI field now chasing ChatGPT-style features. Gross margin slipped to 69% from 74% a year ago as the firm scaled cloud infrastructure and absorbed higher AI inference costs, yet remains comfortably above the 60% level typical of BI peers. That elasticity suggests room for margin expansion once AI features mature and pricing tiers adjust. Even after the bitcoin pivot, R&D intensity stayed near 18% of revenue, underscoring a commitment to product relevance that supports the bullish case of “software plus scarce asset” rather than “bitcoin shell.” Capital Markets Execution Access to deep capital pools is the flywheel powering MicroStrategy’s accumulation strategy. The company raised $4.4 billion via common-stock issuance in Q1 and a further $2.2 billion in April, bringing total net proceeds since January to $7.7 billion. The newly filed $21 billion ATM ensures that every rally in the share price can be opportunistically tapped for fresh bitcoin dry powder, effectively turning equity volatility into treasury alpha. Critics argue that dilution erodes per-share value, but so long as the incremental coins purchased with each dollar of issuance outpace share growth, existing holders capture net bitcoin per share. Q1 data confirm the math: shares outstanding rose 49% year over year, yet bitcoin holdings jumped 119% over the same period, lifting coin-per-share by roughly 47% . Few corporate-finance strategies deliver that kind of asymmetric scaling. Strategy Financials Total Q1 revenue declined 3.6% to $111.1 million as legacy product support continued its predictable slide, but subscription growth more than offset license softness, keeping software ARR flat sequentially. Gross profit of $77.1 million produced a 69% margin, down 460 basis points from last year, primarily on cloud transition expenses rather than competitive pricing pressure. On the balance sheet, cash rose to $60.3 million from $38.1 million at year-end thanks to equity sales, while free cash flow was a manageable negative $11.1 million given heavy AI R&D spend. Enterprise value sits near $110 billion against trailing-twelve-month EBITDA of -$7.6 billion, rendering EV/EBITDA optically meaningless; however, strip out non-cash digital-asset valuation swings and core software EBITDA remains positive, suggesting that traditional multiples understate operating optionality. Guidance is qualitative but aggressive: management expects “BTC Yield” to reach 25% and “BTC $ Gain” to hit $15 billion by year-end if macro liquidity stays supportive. Even if subscription revenue merely grows in mid-single digits, the embedded leverage to bitcoin price could drive book-value expansion far exceeding software peers’ growth rates. Risks Bitcoin’s price path remains the single largest swing factor. A steep drawdown, like a 50% retracement toward $50,000, would inflict mark-to-market losses approaching $30 billion and amplify the GAAP net-loss optics that already spooked investors this quarter. Although new FASB fair-value rules allow upward revaluation in bull markets, they also force quarterly impairments in bear cycles, potentially pressuring sentiment even if cash flow stays intact. Dilution is a second-order concern. If the share price underperforms bitcoin for an extended period, raising equity to buy coins could actually decrease bitcoin per share, reversing the current virtuous cycle. The firm must therefore maintain precise timing discipline in its ATM program. Regulatory headwinds also loom: the SEC’s evolving stance on spot-bitcoin ETFs and corporate crypto disclosures could impose higher compliance costs or limit future capital raises. Finally, software execution cannot be ignored. Should the analytics platform fail to keep pace with AI-native competitors, the non-bitcoin segment could slip into structural decline, depriving MicroStrategy of an operating hedge against crypto volatility. Conclusion At roughly $372 per share, MicroStrategy trades at 1.7x the market value of its 581 thousand bitcoins, meaning investors are paying about $40 billion for a cash-generating BI franchise, active treasury yield, and a management team that has repeatedly demonstrated capital-markets agility. Traditional valuation lenses paint a premium picture: EV/revenue of 258x dwarfs Coinbase’s 8.2x and Riot Platforms’ 7.1x. Price/sales shows a similar gap, while P/E is not meaningful given bitcoin-driven accounting losses. Yet, the comparison is incomplete because neither peer owns an asset base whose dollar value alone covers a majority of enterprise value. If bitcoin merely matches the post-halving trajectories of prior cycles and reaches $150,000 within two years, MicroStrategy’s holdings would be worth $87 billion, enough to cover the current market cap even before further accumulation or software cash flows are considered. In that scenario, the equity would offer embedded optionality on both BTC upside and a potential re-rating of the subscription business toward the 10-12x sales typical of AI-enabled analytics vendors. Given the asymmetric payoff profile, MicroStrategy looks undervalued on a sum-of-parts basis despite headline multiples. For investors who accept bitcoin’s long-term scarcity thesis and see AI-induced monetary expansion as a tailwind rather than a threat, owning MSTR provides operational leverage to both trends. I remain bullish and expect the shares to outperform pure-play miners and exchanges over a full bitcoin cycle, with 50% upside possible if management continues to grow bitcoin per share faster than share count while nurturing subscription growth above 10% annually.

Source: Seeking Alpha