Controversial Claims: Sunil Kavuri Alleges James Wynn’s Trading Mirrors Alameda Research

8 min read

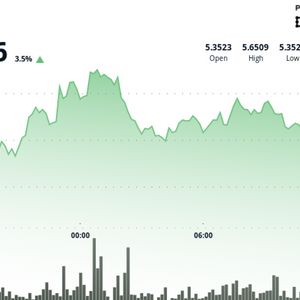

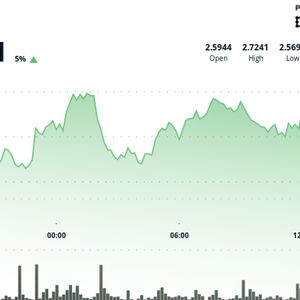

BitcoinWorld Controversial Claims: Sunil Kavuri Alleges James Wynn’s Trading Mirrors Alameda Research In the ever-evolving and often dramatic world of cryptocurrency, allegations and scrutiny are never far away, especially in the wake of major industry events like the collapse of FTX. Recently, a significant claim has emerged from Sunil Kavuri , a prominent representative for FTX creditors, drawing a potentially controversial parallel between the trading activities of a well-known Crypto Whale and the infamous strategies of Alameda Research. What Are the Allegations Against James Wynn? The core of the recent stir comes from Sunil Kavuri , who took to the social media platform X (formerly Twitter) to voice his observations. Kavuri specifically pointed towards the trading behavior of James Wynn , a figure recognized within the crypto community, particularly on platforms like Hyperliquid, for executing large trades. Kavuri’s assertion is that Wynn’s trading patterns bear a striking resemblance to the methods employed by Alameda Research , the sister company to the now-defunct FTX exchange. This comparison is highly significant because Alameda Research was at the heart of the FTX collapse, known for its aggressive trading strategies, privileged access to FTX resources, and accusations of market manipulation. The allegations are not just based on observed trading style. Kavuri’s claims are bolstered by past reports suggesting a direct financial link between Wynn and Alameda. According to previous reporting, James Wynn reportedly received payments from Alameda Research as far back as December 2020. While the nature or purpose of these payments hasn’t been explicitly detailed in the recent claims, their existence raises questions about potential prior connections or arrangements. The focus on Wynn’s trading isn’t new. Data analysis firm Lookonchain previously highlighted Wynn’s remarkable, albeit volatile, performance. They reported that Wynn managed to accumulate over $87 million in profits within a concentrated period of just 70 days. However, this period of immense gains was followed by a precipitous decline, with Wynn reportedly losing nearly all of those profits within a mere five days. This kind of rapid, high-stakes profit and loss cycle is precisely the type of volatile trading often associated with the leveraged and aggressive strategies that characterized Alameda Research . For FTX Creditors , any potential link or resemblance to Alameda’s operations is a sensitive point. These creditors are still navigating the complex process of recovering funds lost in the FTX collapse, a collapse largely attributed to the intertwined and allegedly improper relationship between FTX and Alameda Research. Therefore, any suggestion that entities or individuals may have benefited from or mimicked Alameda’s potentially problematic strategies attracts significant attention and concern from those seeking restitution. Why Does an Alameda Research Comparison Matter? Understanding why the comparison to Alameda Research is so potent requires a look back at what Alameda was and how it operated. Alameda was not just a typical trading firm; it was intrinsically linked to FTX, the exchange founded by the same individual, Sam Bankman-Fried. This relationship allegedly afforded Alameda significant advantages, including: Preferential Execution: Some reports and legal filings suggest Alameda had faster access to market data and execution speeds on FTX compared to regular users. Unlimited Credit Line: Crucially, Alameda allegedly had access to a massive, unchecked line of credit from FTX customer funds, allowing it to take on enormous risks without facing margin calls like other traders. Market Making & Liquidity Provision: While providing a legitimate service, their position also gave them deep insight into order books and market dynamics on FTX. Aggressive & Leveraged Trading: Alameda was known for using high leverage, making large directional bets, and engaging in complex trading strategies across various assets. The collapse revealed that the lines between FTX customer funds and Alameda’s balance sheet were blurred, leading to a multi-billion dollar shortfall when Alameda’s risky bets went south. Therefore, when Sunil Kavuri or others suggest that a trader’s style resembles Alameda’s, it implicitly raises questions about: Whether similar high-risk, high-leverage strategies are being employed. Whether the trader might have had access to unique information or advantages. The potential impact of such large-scale, volatile trading on market stability. For FTX Creditors , it could also stir concerns about whether past activities involving Alameda and other parties contributed to the overall financial picture that led to the exchange’s downfall. Who is Sunil Kavuri and Why Are His Claims Significant? Sunil Kavuri is not just a casual observer; he is a vocal and active representative for the interests of FTX Creditors . As part of the official committee representing unsecured creditors in the FTX bankruptcy proceedings, Kavuri has been deeply involved in the process of understanding what happened, identifying assets, and advocating for the recovery of funds. His role gives his statements a certain weight, as they come from someone directly engaged in scrutinizing the aftermath of the FTX collapse. Kavuri has been particularly critical of various aspects of the bankruptcy process and has actively sought transparency and accountability regarding the handling of assets and the actions of parties involved with FTX and Alameda. His public statements often aim to shed light on potential issues or connections that he believes are relevant to the creditors’ ability to recover their losses. When Sunil Kavuri makes a claim connecting a current significant trader like James Wynn to the methods of Alameda Research , it’s significant because: It highlights the ongoing scrutiny of individuals and entities who may have had dealings with Alameda or FTX prior to the collapse. It suggests that the trading patterns observed by large players in the market are being watched and analyzed for potential red flags. It underscores the concerns of FTX Creditors that the full picture of Alameda’s activities and its relationships with other market participants has yet to be fully revealed. Kavuri’s position allows him access to information and a platform to raise concerns that resonate with the thousands of individuals and institutions who lost funds on FTX. Examining James Wynn’s Trading Activity: What Does the Data Show? The Lookonchain report provides a concrete example of the kind of volatile trading that has drawn attention to James Wynn . Earning $87 million in profits in 70 days is an extraordinary feat, indicative of highly successful, large-scale, and likely leveraged positions. However, losing nearly all of it in just five days is equally remarkable and speaks to the extreme risk involved. This boom-and-bust cycle, while possible for any high-leverage trader, aligns with the kind of outcomes that characterized Alameda’s performance at times. Alameda was known for making massive, sometimes ill-fated, bets that could result in huge swings in their balance sheet. The sheer scale of Wynn’s reported profits and subsequent losses is what makes the comparison to Alameda’s trading style pertinent. Here’s a simplified look at the reported data: Trader Period Reported Profit/Loss Notes James Wynn 70 Days +$87,000,000+ Rapid accumulation of gains James Wynn Following 5 Days ~-$87,000,000 Near total loss of recent gains This table illustrates the extreme volatility. While we don’t have direct, detailed comparisons of specific trade types or strategies used by Wynn versus documented Alameda trades, the overall pattern of massive, rapid swings in capital is a shared characteristic that fuels the comparison made by Sunil Kavuri . It’s important to note that publicly available data on trading performance, like that provided by Lookonchain, often focuses on realized profits and losses on specific addresses or tracked entities. A complete picture of a trader’s strategy would require much more detailed information, including their use of leverage, specific instruments traded (perpetuals, options, spot), entry and exit points, and risk management techniques (or lack thereof). Are These Allegations Actionable? Challenges and Implications While Sunil Kavuri ‘s claims connecting James Wynn ‘s trading to Alameda Research methods are significant within the community, proving a direct, improper link or actionable wrongdoing based solely on trading style and past payments presents challenges. Here are some points to consider: Proving “Trading Style”: Trading styles can resemble each other without implying collusion or improper advantage. Many large traders use similar high-leverage, high-frequency techniques, especially in volatile markets. Nature of Past Payments: The reported payments from Alameda to Wynn in 2020 would need further investigation. Were they for services rendered (e.g., market making, consulting), investments, or something else? The context is crucial. Lack of Direct Evidence (Publicly): Kavuri’s statement is an observation and a claim. Proving it in a legal or regulatory sense would require concrete evidence of coordinated activity, shared information, or specific instances of market manipulation linked to the alleged connection. Regulatory Interest: Claims like these, especially involving large traders and comparisons to entities involved in a major collapse, could potentially attract the attention of regulatory bodies interested in market integrity and past dealings related to FTX and Alameda. Impact on FTX Creditors: For FTX Creditors , uncovering any assets or past transactions that could potentially be clawed back or that shed light on the collapse is paramount. If there were any improper dealings between Alameda and other parties, identifying them is key to the recovery process. The implications of these allegations extend beyond just Wynn and Alameda. They highlight the ongoing scrutiny of large players in the crypto market, the methods they employ, and their historical connections to now-collapsed entities. They also underscore the persistent efforts of FTX Creditors and their representatives like Sunil Kavuri to piece together the full story of the FTX/Alameda saga and maximize recovery. The crypto market is still grappling with the fallout from 2022, and transparency regarding the activities of major players and defunct firms remains a critical concern for restoring trust and ensuring market health. The allegations against James Wynn , while needing further substantiation, serve as a reminder that the past is still very much relevant to the present state and future regulation of the industry. Conclusion: The Ongoing Shadow of Alameda Research Sunil Kavuri ‘s claims linking James Wynn ‘s trading style to that of Alameda Research have injected a new point of discussion into the crypto community, particularly among those affected by the FTX collapse. The reported past payments from Alameda to Wynn and the documented volatility of Wynn’s trading performance, including rapid nine-figure swings, provide the basis for Kavuri’s comparison. While the resemblance in trading style and historical financial ties do not automatically prove improper conduct, they are sufficient to raise questions and warrant attention, especially from the perspective of FTX Creditors . The shadow of Alameda Research continues to loom large over the crypto space, and any suggestion of its methods or connections resurfacing or influencing current market dynamics is bound to be met with scrutiny. As the FTX bankruptcy proceedings continue and the market matures, transparency, data analysis, and the vigilance of representatives like Sunil Kavuri play a crucial role in understanding past events and potentially identifying ongoing risks or previously undisclosed relationships. The allegations against James Wynn are a stark reminder that the complex web of connections from the 2022 crypto downturn is still being untangled. To learn more about the latest developments concerning FTX creditors and the broader impact on crypto trading , explore our articles on key events shaping the future of the crypto market . This post Controversial Claims: Sunil Kavuri Alleges James Wynn’s Trading Mirrors Alameda Research first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World