Crypto Proponent Calls $240 XRP Price

4 min read

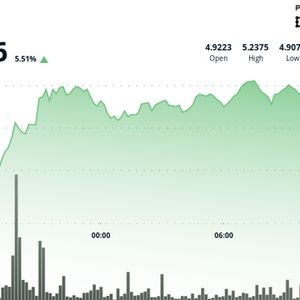

In a bold declaration that has ignited excitement across the XRP community, prominent crypto influencer JackTheRippler took to X to assert: “You are not ready for $240 per XRP! Are you?” The provocative post, typical of JackTheRippler’s high-impact style, has once again brought the long-debated question of XRP’s true valuation into sharp focus. While the $240 price point may seem fantastical to skeptics, a closer look at market fundamentals, macroeconomic trends, and Ripple’s evolving legal and technological posture suggests that such targets, though distant, may not be entirely out of the question. You are not ready for $240 per #XRP ! Are you? pic.twitter.com/gXVWJrwF5P — JackTheRippler ©️ (@RippleXrpie) May 23, 2025 The Weight of a Bold Prediction JackTheRippler, known for his unwavering support of XRP and a large following on X, has often forecasted bullish scenarios for the digital asset, particularly in the context of its real-world utility and institutional adoption. His latest call for a $240 valuation represents over 10,000% increase from XRP’s current market price of around $2.36. At first glance, such a prediction may sound overly optimistic or even implausible. However, price predictions in crypto often reflect broader narratives about future utility, regulatory clarity, and cross-border financial adoption. It’s important to recognize that this isn’t the first time the XRP community has entertained high-value projections. Over the years, analysts and enthusiasts alike have speculated on XRP’s potential to transform global payments infrastructure. The basis of these lofty projections typically centers around Ripple’s technology, including On-Demand Liquidity (ODL) , the XRPL’s scalability, and partnerships with financial institutions. Ripple’s Legal Standing: A Crucial Catalyst Any discussion about XRP’s future price must account for the ongoing legal saga between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). In July 2023, U.S. District Judge Analisa Torres delivered a partial victory for Ripple by ruling that XRP is not a security when sold to the public via exchanges. This pivotal decision sent XRP’s price surging and provided long-awaited regulatory clarity that many believe lays the foundation for institutional adoption. Despite the recent improvements, the case is not entirely closed. Should Ripple emerge fully vindicated, major financial players that had previously been hesitant could begin onboarding XRP as a core component of their cross-border payment systems. Institutional Adoption and Utility: The Core of the Bull Thesis To justify a $240 valuation, XRP would require a level of demand and utility unprecedented in today’s digital asset space. Unlike purely speculative tokens, XRP was designed with functionality in mind, specifically for facilitating fast, low-cost international transactions. Ripple’s ODL product leverages XRP to enable near-instant settlement, eliminating the need for pre-funded accounts. Financial institutions in countries like Japan, Mexico, and the Philippines have already adopted this model and are more poised to join once legal uncertainties subside. We are on twitter, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) July 15, 2023 Furthermore, recent developments surrounding the XRPL’s EVM-compatible sidechain—spearheaded by Peersyst Technology—could dramatically expand XRP’s utility within the decentralized finance (DeFi) space. By allowing Ethereum-based smart contracts to run seamlessly on XRPL, this innovation could attract developers, dApps, and liquidity to the ecosystem, driving network value. Global Macroeconomics and Token Scarcity Beyond technology and regulation, macroeconomic shifts also play a pivotal role in shaping long-term crypto valuations. With fiat currencies facing increasing inflationary pressures, institutional investors are seeking alternatives that can offer both utility and a hedge against devaluation. If XRP is positioned as both a bridge currency and a store of value , the conditions could converge in its favor. Tokenomics further supports this view. XRP has a capped supply of 100 billion coins, with a significant portion held in escrow and gradually released into the market. As adoption grows and the circulating supply tightens, scarcity dynamics could amplify price movements. High-value use cases—such as central bank digital currencies (CBDCs) interoperability, international remittances, and tokenized asset transfers—could create sustained demand, leading to exponential price appreciation. A Vision or a Mirage? JackTheRipper’s $240 XRP forecast is undeniably ambitious, but it isn’t devoid of logic. It’s a vision anchored in the belief that XRP will become integral to the future of finance, streamlining global liquidity, reducing friction in capital flows, and serving as the backbone for a decentralized financial system. For such a valuation to materialize, Ripple would need to triumph fully in court, achieve global regulatory recognition, and see XRP adopted at scale across banking, trade, and fintech ecosystems. Whether or not the market is “ready” for $240 XRP, as JackTheRippler suggests, is a question only time will answer. But in the ever-evolving world of crypto, where narratives can shift overnight and breakthroughs often follow long periods of dormancy, no target is truly out of reach. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Crypto Proponent Calls $240 XRP Price appeared first on Times Tabloid .

Source: TimesTabloid