Researcher Shows Why BlackRock Isn’t Moving On An XRP ETF Yet

4 min read

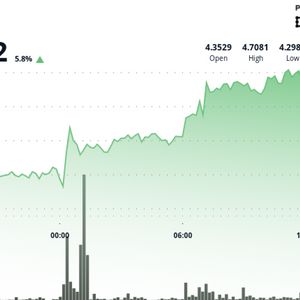

A recent post by Crypto Researcher SMQKE outlines the current reasons why BlackRock, the world’s largest asset manager, has not yet filed for an XRP exchange-traded fund (ETF), despite clear market demand for such a product. According to Bloomberg Intelligence, the SEC’s ongoing uncertainty around classifying digital assets like XRP as either securities or commodities remains a critical roadblock. Why BlackRock Is Holding Off on an XRP ETF Filing BlackRock isn’t moving on an XRP ETF yet even though XRP is one of the most in demand altcoins for an ETF. Here’s why: 1. Short-Term Regulatory Uncertainty The SEC still hasn’t fully defined whether XRP and other… pic.twitter.com/JUKYeykjT4 — SMQKE (@SMQKEDQG) May 21, 2025 While a U.S. court has previously ruled that XRP itself is not a security, the SEC continues to delay ETF-related decisions, pushing several altcoin ETF filings, including XRP, into late 2025. This lack of regulatory clarity appears to be one of the most significant deterrents for BlackRock and other institutional players seeking to expand their ETF offerings. The SEC has postponed ETF decisions for a range of altcoins, including Solana, Litecoin, Hedera, Polkadot, and Dogecoin, with new deadlines now set for June or October 2025. Without a clear classification framework, even the most advanced ETF applications remain in a holding pattern. According to the analysis shared by SMQKE, BlackRock is likely waiting for definitive regulatory guidelines before committing to any XRP ETF initiative. Institutional-Grade Derivatives Still in Early Stages Another reason cited by SMQKE relates to the maturity of XRP’s derivatives market. Institutional investors typically rely on regulated derivatives such as CME futures to hedge risk and increase capital efficiency. Bitcoin and Ethereum both have a long-established record of trading on the CME, giving them a significant institutional advantage. In contrast, XRP only launched its CME futures product on May 19, 2025, with a first-day volume of $19 million. Although this launch marks a key milestone for XRP in becoming institutionally viable, Bloomberg Intelligence notes that XRP, along with other altcoins like BNB and Litecoin, still sits largely outside of deeply regulated derivatives markets and portfolio models. Institutions typically wait for prolonged, high-volume activity before allocating capital at scale. As a result, BlackRock may be holding back until XRP’s derivatives market demonstrates more consistent depth and engagement. We are on twitter, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) July 15, 2023 Market Liquidity and ETF Readiness Kaiko Research highlights that XRP is one of the most liquid altcoins, particularly when measured by average 1% market depth. XRP even surpassed Solana and doubled Cardano’s market depth since the end of 2024. This metric indicates strong potential for ETF viability. However, Kaiko also stresses that ETFs require not just liquidity, but consistent and scalable liquidity to accommodate significant institutional inflows and outflows. The SEC remains sensitive to this issue, and BlackRock is likely monitoring XRP’s liquidity over time before proceeding. Despite these limitations, XRP continues to lead in terms of investor interest. According to recent fund flow data, XRP was responsible for nearly $40 million in net inflows over a single week, offsetting Ethereum’s $26 million in outflows. Additionally, data from Eric Balchunas shows XRP and Solana are currently the most in-demand altcoins in ETF applications, with ten and six institutional filings, respectively. Strategic Resource Allocation and Market Timing SMQKE also notes that BlackRock may be focusing its resources on the success of its Bitcoin and Ether ETF products, which are already attracting significant capital inflows. With these offerings performing strongly, the firm may be prioritizing scale and stability over diversification into altcoin ETFs under uncertain conditions. Finally, BlackRock’s approach appears to be strategically timed. XRP and Solana lead ETF application activity, and BlackRock may be waiting to observe how the SEC handles these products before making its move. With XRP’s growing market depth, recent CME futures launch, and strong investor demand, conditions are gradually aligning in its favor. But until regulatory clarity improves and XRP’s institutional infrastructure matures further, BlackRock seems content to wait. As SMQKE concludes, BlackRock is not uninterested in an XRP ETF — it is simply waiting for the right convergence of regulation, market structure, and liquidity. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post Researcher Shows Why BlackRock Isn’t Moving On An XRP ETF Yet appeared first on Times Tabloid .

Source: TimesTabloid