Institution wallet dumps Lido DAO and Blur, triggering up to 25% price decline

3 min read

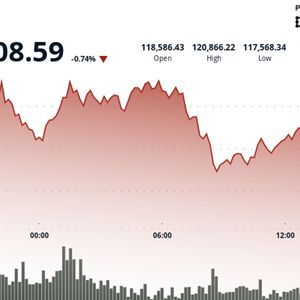

While Bitcoin’s latest rebound past $105K renewed the altcoin season narrative, blockchain data suggests a delay, with key investors reducing their exposure. An institution or whale investor has dumped massive amounts of Lido DAO Token and Blur Coin in what seems to be an organized move. On-chain analytics platform Lookonchain highlighted that the wallet transferred 21.3 million LDO, worth around $21.6 million, and 34.2 million BLUR, worth approximately $4 million, into top centralized exchanges, including Binance, Bybit, Gate.io, and OKX, within the previous week. Lookonchain @lookonchain · Follow A whale/institution is dumping $LDO and $BLUR !Over the past week, they deposited 21.3M $LDO ($21.6M) and 34.2M $BLUR ($4M) into exchanges.They still hold 9.22M $LDO ($8.15M) and 43.69M $BLUR ($4.5M) left. $LDO dropped 25% and $BLUR dropped 20% in the past week. 11:30 AM · May 19, 2025 159 Reply Copy link Read 19 replies The transactions have grabbed the cryptocurrency community’s attention, especially due to the massive price dips. LDO lost 25% within a week, while BLUR declined by 20%. Whale moves dent market sentiment Whale transactions are crucial as they set the market’s tone, especially for smaller-cap tokens like BLUR and Lido DAO. These entities accumulate assets with upside potential and dump those with weak momentum. Moreover, retail investors adopt panic selling when top holders begin to offload their holdings. That will potentially lead to intensified downward pressure on cryptocurrency’s price. The latest dump has already triggered negative sentiments around LDO and BLUR. The altcoins display bearish dominance, hinting at continued declines in the near term. LDO’s daily trading volume has increased by 65%, while BLUR sees a 78% uptick in the same metric. Soaring trader activity amid negative sentiments often signals magnified selling activities. LDO hovers at $0.8700, whereas BLUR trades at $0.1019 per token, reflecting significant losses on their daily price charts. Source – Coinmarketcap Moreover, the wallet still holds considerable amounts of Lido DAO and Blur tokens. It has 9.22 million LDO and 43.69 million BLUR, worth around $8.15M and $4.5M, respectively, at market values. Will the wallet continue dumping as prices display weakness? Such a trend could mean further LDO and BLUR declines in the upcoming times. Insider knowledge While unmasking transactions in the crypto world is a challenge, enthusiasts are buzzing with theories. The massive transaction and remaining balance showed this isn’t an ordinary investor. EmberCN links LDO’s transaction to a team member or early participants who received the assets before listing. For BLUR, the transfers could be from an airdrop recipient or token unlocks. Furthermore, the investors could be leveraging the latest rallies to take profits at favorable prices, especially as the prevailing broad consolidations hint at short-term corrections before upside resumptions. Crypto market overview Digital tokens traded in red on Monday, with the global crypto market cap down 2% in the past 24 hours to $3.24 trillion. Popular analyst Ali Martinez expects a BTC dip to $101.3K support after rejection above $105K. Ali @ali_charts · Follow Big rejection again at $105,900. Key support for #Bitcoin $BTC now at $103,400 and $101,300! 11:26 PM · May 18, 2025 450 Reply Copy link Read 50 replies Bitcoin trades at $102,390 after losing 1.55% in the past 24 hours (CoinMarketCap’s data). The post Institution wallet dumps Lido DAO and Blur, triggering up to 25% price decline appeared first on Invezz

Source: Invezz