Uphold Releases XRP Top Report for the Week

4 min read

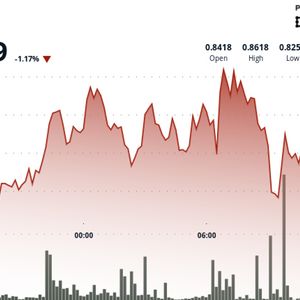

In a significant development for the cryptocurrency market, CME Group, the world’s leading derivatives marketplace, has announced plans to launch XRP futures contracts on May 19, 2025, pending regulatory approval. This move, highlighted in a recent report by Uphold, marks a pivotal moment for XRP, signaling growing institutional interest and the maturation of the digital asset’s market infrastructure. Here’s your #XRP Report for the week: CME Group to Launch XRP Futures on May 19 CME Group is set to launch $XRP futures on May 19, pending regulatory approval. This marks a major step toward institutional adoption of XRP, offering new tools for both hedging and… pic.twitter.com/i0pHj3wXSq — Uphold (@UpholdInc) May 17, 2025 CME Group’s Strategic Expansion into XRP Futures CME Group’s decision to introduce XRP futures is a strategic expansion of its crypto derivatives offerings, which already include Bitcoin, Ethereum, and Solana futures. The new XRP futures contracts will be cash-settled and available in two sizes: a micro contract covering 2,500 XRP and a standard contract of 50,000 XRP. These contracts will be based on the CME CF XRP-Dollar Reference Rate, calculated daily at 4:00 p.m. London time, ensuring transparent and consistent pricing for market participants. Giovanni Vicioso, CME Group’s Global Head of Cryptocurrency Products, emphasized the growing interest in XRP and its underlying technology: “Interest in XRP and its underlying ledger (XRPL) has steadily increased as institutional and retail adoption for the network grows, and we are pleased to launch these new futures contracts to provide a capital-efficient toolset to support clients’ investment and hedging strategies”. Market Implications and Institutional Adoption The introduction of XRP futures by CME Group is expected to have significant implications for the market. It provides institutional investors with regulated instruments to hedge against price volatility and gain exposure to XRP without the need to hold the underlying asset. This development is particularly noteworthy given the recent increase in XRP’s trading volume and institutional interest. In the first quarter of 2025, CME Group reported an average daily volume of 198,000 contracts across its crypto futures and options, representing approximately $11.3 billion in notional value, a 141% increase year-over-year. Open interest also surged by 83% to 251,000 contracts, equivalent to $21.8 billion in notional value. The addition of XRP futures is expected to further bolster these figures, reflecting the growing demand for diversified crypto investment products. Retail Access and Broader Market Impact In addition to institutional adoption, the launch of XRP futures is poised to enhance retail investor participation. Trading platform Robinhood has confirmed plans to offer CME’s XRP futures to its users, broadening retail access to these regulated instruments. JB Mackenzie, Robinhood’s VP and GM of Futures and International, stated that adding XRP futures aligns with the platform’s mission to enhance retail investor participation in futures markets, complementing its existing spot crypto offerings. We are on twitter, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) July 15, 2023 The availability of XRP futures on platforms like Robinhood democratizes access to sophisticated financial instruments, allowing a broader range of investors to engage with the crypto derivatives market. This increased accessibility is expected to contribute to greater liquidity and price discovery in the XRP market. Potential for Spot XRP ETFs The establishment of a regulated futures market for XRP may also pave the way for the approval of spot XRP exchange-traded funds (ETFs). The existence of a futures market under the Commodity Futures Trading Commission (CFTC) could address previous concerns from the Securities and Exchange Commission (SEC) regarding market manipulation and investor protection. Several asset managers have already filed proposals for spot XRP ETFs, with projections suggesting these could attract substantial assets upon approval. The upcoming launch of XRP futures by CME Group represents a significant milestone in the evolution of the cryptocurrency market. By providing regulated, transparent, and accessible instruments for both institutional and retail investors, this development underscores the growing maturity and acceptance of digital assets in mainstream finance. As the market continues to evolve, the introduction of XRP futures is poised to play a crucial role in shaping the future landscape of crypto investment and risk management. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Uphold Releases XRP Top Report for the Week appeared first on Times Tabloid .

Source: TimesTabloid