EUR CZK Forecast: UBS Reveals Crucial Shift on Easing Tariff Concerns

4 min read

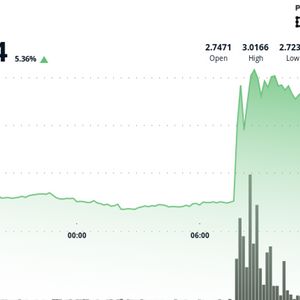

BitcoinWorld EUR CZK Forecast: UBS Reveals Crucial Shift on Easing Tariff Concerns In the dynamic world of global finance, shifts in macroeconomic factors frequently dictate market movements, influencing everything from traditional assets to the broader sentiment felt even in cryptocurrency markets. Understanding these underlying currents is vital. A significant development drawing attention is UBS’s recent revision to its EUR CZK forecast , driven primarily by an assessment that global tariff concerns are easing. What Drives the EUR CZK Forecast? The exchange rate between the Euro (EUR) and the Czech Koruna (CZK) is influenced by a complex interplay of economic factors. These include: Interest rate differentials between the Eurozone and the Czech Republic. Economic growth prospects in both regions. Inflation rates. Political stability. Global trade dynamics and geopolitical events. Major financial institutions like UBS regularly analyze these factors to provide their EUR CZK forecast , offering valuable insights into potential currency movements. Their assessments are closely watched by investors, businesses involved in trade between the regions, and policymakers. UBS Forecast: Responding to Eased Tariff Concerns UBS forecast revisions often stem from changes in their view on key economic indicators or external pressures. The recent adjustment to the EUR CZK forecast is directly linked to a perceived reduction in global tariff concerns . For an export-oriented economy like the Czech Republic, which is deeply integrated into European and global supply chains, trade policies and potential barriers like tariffs have a considerable impact on economic health and, consequently, the value of the Czech Koruna outlook . When the risk of new tariffs or escalation of existing trade disputes diminishes, it generally supports economic activity, boosts business confidence, and can lead to a more favorable outlook for currencies tied to trade, such as the CZK. Impact on the Czech Koruna Outlook A lowered EUR CZK forecast by UBS suggests that they anticipate the Koruna to strengthen relative to the Euro, or at least depreciate less than previously expected. This positive shift in the Czech Koruna outlook is a direct consequence of their updated view on global trade tensions. Key implications for the Czech Koruna outlook include: Improved Export Prospects: Eased tariffs mean Czech exporters face fewer barriers, potentially leading to stronger export performance. Increased Investor Confidence: Reduced trade uncertainty can attract foreign investment into the Czech Republic. Inflationary Pressures: A stronger Koruna can help temper import price inflation, which is a key consideration for the Czech National Bank (CNB). This positive reassessment by a major player like UBS provides a more optimistic perspective on the currency’s near-term trajectory. Why Forex Analysis Matters Understanding Forex analysis is not just for currency traders. Businesses with international operations, investors holding foreign assets, and even individuals planning international travel can benefit from insights into currency movements. A comprehensive Forex analysis considers macro trends, central bank policies, political events, and global sentiment. The case of the EUR CZK forecast and UBS’s revision highlights how specific factors, like tariff concerns , are integrated into sophisticated Forex analysis to arrive at a view on a currency pair’s future direction. This type of analysis provides context for market behavior and helps anticipate potential shifts. Navigating the Implications: What Does This Mean? For market participants, the revised UBS forecast is a signal. It suggests that the tailwinds from easing trade tensions are expected to be supportive of the Czech Koruna. While no forecast is guaranteed, it informs trading strategies and risk management for those exposed to the EUR/CZK pair. For the broader economy, reduced tariff concerns lower a significant source of uncertainty that has weighed on global growth prospects. This positive sentiment can have ripple effects across financial markets. Challenges and Considerations Despite the positive revision based on eased tariff concerns , challenges remain. Global trade dynamics can shift rapidly, influenced by political developments. Other factors like inflation, energy prices, and the monetary policy stance of the European Central Bank and the CNB continue to play a significant role in the EUR CZK forecast . Therefore, while the immediate outlook is influenced by the tariff assessment, a holistic view is necessary. Conclusion: A Brighter Czech Koruna Outlook UBS’s decision to lower its EUR CZK forecast is a noteworthy development, primarily driven by a more optimistic view on the resolution or easing of global tariff concerns . This revised UBS forecast paints a more favorable picture for the Czech Koruna outlook , suggesting potential resilience or strengthening against the Euro. It underscores the critical link between global trade policies and currency valuations, a key element in sophisticated Forex analysis . While uncertainties persist in the global economic landscape, this specific adjustment by a major financial institution provides a moment of clarity and a potentially positive signal for the Czech currency based on improving external conditions. To learn more about the latest Forex market trends, explore our article on key developments shaping global currency pairs. This post EUR CZK Forecast: UBS Reveals Crucial Shift on Easing Tariff Concerns first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World