ETH eyes $2.8K, ADA rallies — but Mutuum Finance (MUTM) quietly gains serious attention

4 min read

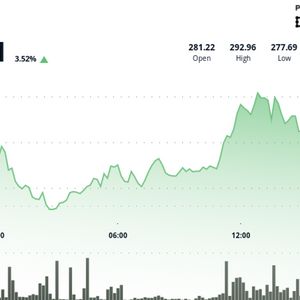

As crypto markets continue to recover from months of sideways action, two familiar giants are making headlines again. Ethereum (ETH) has pushed toward the $2.8K resistance zone, reinforcing bullish sentiment, while Cardano (ADA) is showing signs of a fresh breakout with traders now targeting higher levels. While ETH and ADA remain in the spotlight, a lesser-known project, Mutuum Finance (MUTM) , has been steadily gaining traction — with some analysts suggesting that the more compelling opportunity might actually lie beneath the surface. Ethereum (ETH) Ethereum (ETH) has seen a gradual recovery, recently moving beyond the $2,500 mark and approaching the $2,800 level, an area that has historically acted as a technical barrier. This movement appears to align with increasing attention around Ethereum Layer 2 development and broader discussions surrounding potential spot ETF approvals. Activity among long-term holders has also picked up, suggesting a cautious yet steady shift in market sentiment. While Ethereum continues to play a central role in the broader ecosystem, its current positioning reflects that of a more established asset. For those prioritizing early growth potential, ETH is often viewed as a stabilizing presence rather than a vehicle for aggressive short-term gains. As larger assets continue to consolidate, some investors are beginning to explore newer opportunities with more headroom for upside. Cardano (ADA) Cardano (ADA) has recently moved out of a tight trading range, hovering near $0.78, with intraday activity briefly crossing $0.84. The price action has drawn attention from analysts who are observing early signs of a potential shift in market behavior. Recent developments within the Cardano ecosystem — including protocol enhancements and increased large-holder activity — have contributed to renewed interest in the token. Although ADA continues to maintain a strong community and active roadmap, its price movements in the past have often been met with resistance after initial breakouts. With larger caps drawing attention, many investors are quietly redirecting their focus toward smaller, under-the-radar projects showing steady momentum from the ground up. Mutuum Finance (MUTM) Mutuum Finance remains in its early phase of development, currently offering its token at a presale price of $0.025. Over $8.2 million has already been raised, and with more than 9,800 holders participating, the project has already surpassed expectations for this phase. With less than 30% of the current round remaining, the token is expected to climb to $0.03 in the next phase, then to $0.06 at launch. But it’s the projections post-launch that are raising eyebrows. Thanks to its built-in utilities and income-sharing model, analysts believe MUTM could surge to $1 or more within weeks of going live. That marks a potential gain of 3,900% compared to the current presale valuation. As an example, investing $1,000 at today’s price would turn into $40,000 when MUTM reaches $1, presenting a level of upside that few established cryptocurrencies are positioned to offer at this point. Mutuum is developing a non-custodial lending protocol that allows users to earn yield on deposited assets while also accessing liquidity through overcollateralized borrowing. The platform’s structure ensures that capital is used efficiently, while holders of mtTokens — which represent deposits — benefit from interest and additional token distributions. One standout aspect of the project is how it handles revenue. A share of the platform’s revenue is allocated to purchasing MUTM tokens from the open market, which are subsequently rewarded to users who hold mtTokens. This ongoing cycle of participation and redistribution ties the token’s growth directly to the platform’s usage — creating organic, long-term value. The team isn’t just promising features — they’re building in real time. A beta version of the platform is scheduled to launch around the time the token goes live, giving users immediate access to the core protocol. This real product rollout distinguishes MUTM from other presale tokens that often delay development. Mutuum is also working on a fully overcollateralized stablecoin, intended to uphold a 1:1 peg to the US dollar using algorithmic controls. The stablecoin will be minted from excess collateral and burned as loans are closed, keeping its supply in balance with platform activity. Unlike many stablecoins, there’s no reliance on centralized reserves — everything remains transparent and on-chain. While ETH and ADA make headlines with their upward moves, MUTM is quickly becoming one of the best cheap cryptos to buy now for those looking beyond top-tier tokens. With a 140% gain locked in by launch and projections suggesting a potential surge to $1, the current entry point may not be around much longer. For investors wondering what cryptocurrency to invest in today — one with clear utility, early pricing, and a working product on the way — Mutuum Finance could be one of the standout tokens to keep an eye on as the next phase of the bull market takes shape. For more information about Mutuum Finance (MUTM) visit the links below: Website: https://www.mutuum.finance/ Linktree: https://linktr.ee/mutuumfinance The post ETH eyes $2.8K, ADA rallies — but Mutuum Finance (MUTM) quietly gains serious attention appeared first on Invezz

Source: Invezz