Spot Bitcoin ETFs Hit $128B AUM as Crypto Funds Gain $882M; Hyperliquid Open Interest Hits $5.6B

1 min read

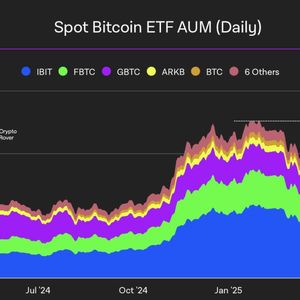

Digital asset investment products experienced robust inflows last week, totaling $882 million and extending a four-week streak of gains that have pushed 2025 year-to-date inflows to $6.7 billion. Bitcoin (BTC) led the inflows with $867 million, significantly contributing to the surge in U.S. spot Bitcoin exchange-traded funds (ETFs), which reached a new all-time high (ATH) in assets under management (AUM) at $128.03 billion. As of May 9, U.S. spot Bitcoin ETFs held approximately 1.175 million BTC, just 6,500 BTC shy of the historical peak of 1.182 million BTC, indicating renewed demand strength. Additionally, Bitcoin spot ETFs recorded a total net inflow of $335 million over three consecutive days ending May 9. Ethereum (ETH) spot ETFs also saw positive inflows, totaling $17.61 million across nine products with no outflows reported. Hyperliquid, a crypto trading platform known for its zero-gas, lightning-fast execution model, set a new record with open interest reaching $5.6 billion. The platform also recorded a net inflow of $548 million during the week of May 5–11, including a single-day record inflow of $200 million on May 8. Other cryptocurrencies such as Sui Network ($SUI) attracted $11.7 million in inflows, leading year-to-date flows at $84 million compared to Solana’s $76 million. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant