Robinhood to Enable 24/7 Trading of Tokenized U.S. Securities in Europe on Arbitrum, Ethereum, or Solana Amid SEC Policy Shift

1 min read

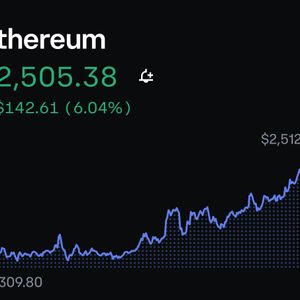

Robinhood Markets Inc. is developing a blockchain-based platform to enable European retail investors to trade tokenized U.S. securities. The platform, in partnership with a digital-asset firm, is considering using Arbitrum, Ethereum, or Solana as its underlying blockchain technology, according to sources familiar with the matter. The platform aims to offer 24/7 trading, leveraging the benefits of tokenization such as data security, faster transaction settlement, and increased liquidity. This development coincides with the Securities and Exchange Commission (SEC) signaling a change in its approach to blockchain securities regulation. SEC Commissioner Hester Peirce has indicated that the regulator is considering an exemption from registration for firms using distributed ledger technology (DLT) to issue, trade, and settle securities. To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant