Trump Tariffs: Urgent Warning on Future US Trade Policy and Economic Impact

6 min read

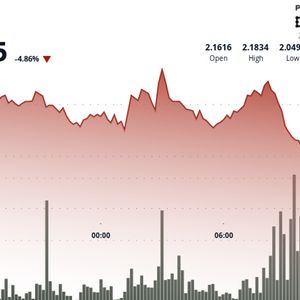

A significant statement from former U.S. President Donald Trump is sending ripples through discussions about future US trade policy . According to reports from Solid Intel on X, Trump indicated that a previously mentioned 10% tariff baseline is not a fixed template for future trade agreements. Instead, he suggested that future rates could, and likely would, be higher. This declaration signals a potentially more aggressive stance on trade should he return to office, with profound implications not just for international commerce but also for global financial markets, including the burgeoning cryptocurrency market reaction . Understanding the Potential Scale of Trump Tariffs What exactly does a potential move towards higher Trump tariffs mean? Tariffs are essentially taxes on imported goods. They can be used as a tool to protect domestic industries, generate government revenue, or exert pressure in international negotiations. During his previous term, Trump implemented tariffs on various goods, notably from China, leading to trade disputes that impacted supply chains and market stability. The mention of the 10% figure previously was seen by some as a potential starting point for negotiations or a general floor. The latest comments suggest that this floor might be removed, allowing for potentially much higher rates on specific imports or across broader categories of goods. This uncertainty regarding the scale and targets of future tariffs creates a complex environment for businesses, consumers, and investors worldwide. The Economic Impact of Tariffs: More Than Just Import Costs The direct economic impact of tariffs is felt by importers, who pay the tax. However, these costs are often passed down the line, affecting consumers through higher prices on imported goods. This can contribute to inflation. Beyond direct costs, tariffs can trigger a cascade of effects: Increased Costs for Businesses: Companies relying on imported raw materials or components face higher operational costs, potentially reducing profitability or forcing price increases. Reduced Consumer Spending: Higher prices for goods can reduce consumer purchasing power, dampening overall demand. Retaliation from Trading Partners: Other countries often respond to tariffs by imposing their own tariffs on exports from the tariff-imposing nation. This can harm domestic industries that rely on exports. Supply Chain Disruption: Businesses may need to find new suppliers, which can be costly and time-consuming, leading to inefficiencies and potential shortages. Reduced Global Trade: A cycle of escalating tariffs can slow down international trade, impacting global economic growth. These potential outcomes paint a picture of increased economic friction and uncertainty on a global scale. Markets dislike uncertainty, and significant shifts in US trade policy can lead to volatility across various asset classes. How Might the Cryptocurrency Market React to Trade Tensions? While tariffs and trade policy might seem distant from digital assets like Bitcoin or Ethereum, macroeconomic shifts have a significant influence on investor sentiment and capital flows into the cryptocurrency market reaction . Here’s how potential trade escalations could play out: 1. Safe-Haven Narrative for Bitcoin: In times of increased global economic uncertainty and potential currency devaluation (due to trade wars or inflation), assets perceived as ‘digital gold’ or hedges against traditional financial instability can see increased interest. Bitcoin and tariffs could become linked if investors view BTC as a non-sovereign store of value less susceptible to the direct impacts of national trade disputes or currency manipulation. 2. Increased Volatility: Macroeconomic news, especially related to major economies and trade, often correlates with volatility in both traditional and crypto markets. Heightened trade tensions could contribute to sharper price swings in the crypto space as investors react to the changing global landscape. 3. Impact on Risk Appetite: If trade wars lead to a broader economic downturn or significant stock market corrections, this could decrease overall risk appetite. Crypto, still largely considered a risk asset, might see outflows as investors move towards safer havens (though some might argue Bitcoin *is* the safer haven in this specific scenario). 4. Capital Flows and Liquidity: Changes in global trade patterns and economic health can affect international capital flows. While the direct link to crypto is complex, major shifts in liquidity or investor focus due to trade policy could indirectly impact the crypto market. 5. Government Focus and Regulation: A potential shift in administration and economic policy could also bring changes in regulatory focus towards digital assets. While not a direct consequence of tariffs, it’s part of the broader political and economic platform that could impact the crypto space. Bitcoin and Tariffs: Is There a Historical Link? Examining past periods of significant tariff action, such as during 2018-2019, can offer some clues, though the crypto market was less mature then. During those trade tensions, Bitcoin did experience significant price movements, but disentangling the impact of tariffs from other factors (like market cycles, regulatory news, and technological developments within crypto) is challenging. However, the narrative of Bitcoin as a hedge against economic instability and traditional financial system risks gained traction during those periods of uncertainty. The core argument linking Bitcoin and tariffs rests on the idea that policies disrupting traditional trade and potentially leading to inflation or currency instability make decentralized, hard-capped assets like Bitcoin more attractive as alternative stores of value. Challenges and Opportunities for Crypto Amidst Trade Policy Shifts The potential for increased tariffs presents both challenges and opportunities for the cryptocurrency market : Challenges: Broader market downturns could drag crypto prices down regardless of its potential as a hedge. Increased economic hardship globally could reduce discretionary income available for crypto investment. Regulatory uncertainty could increase under a new administration, potentially overshadowing macro factors. Opportunities: Enhanced narrative for Bitcoin as a hedge against inflation and economic instability caused by trade wars. Potential for increased adoption in regions heavily impacted by currency fluctuations or trade restrictions. Growing awareness of decentralized assets as alternatives to traditional financial systems tied to national policies. Actionable Insights for the Crypto Investor Given the potential for shifts in US trade policy and their subsequent economic impact of tariffs , what should crypto investors consider? 1. Stay Informed on Macro News: Pay attention not just to crypto-specific news but also to global economic indicators, trade policy developments, and political statements regarding tariffs. These factors are increasingly influencing market sentiment. 2. Evaluate Your Portfolio’s Sensitivity: Consider how different assets in your portfolio might react to increased economic uncertainty. Bitcoin might perform differently than smaller altcoins heavily tied to specific tech narratives. 3. Understand the Narrative: Be aware of the ‘digital gold’ or ‘inflation hedge’ narratives surrounding Bitcoin and other assets. While not guaranteed outcomes, these narratives gain strength during periods of economic instability. 4. Long-Term Perspective: While short-term volatility is possible due to news events like tariff announcements, maintaining a long-term perspective based on the underlying technology and adoption trends of promising crypto projects is crucial. 5. Diversification: As always, diversification remains a key strategy. This includes diversifying within the crypto space and considering how crypto fits into your overall investment portfolio alongside traditional assets. The Broader Picture: US Trade Policy and Global Economic Stability Trump’s comments underscore a potential future direction where trade policy remains a central and potentially aggressive tool. This approach can lead to unpredictable outcomes for global markets. The interconnectedness of the modern economy means that shifts in US trade policy do not happen in a vacuum. They affect currency exchange rates, commodity prices, international relations, and ultimately, investor confidence. The discussion around Trump tariffs is therefore not just about trade figures; it’s about the potential for a fundamental shift in how the world’s largest economy interacts with others, creating ripples that touch everything from manufacturing jobs in the Midwest to the price of imported electronics, and yes, even the volatile world of cryptocurrency. Concluding Thoughts: Navigating Uncertainty The statement from Donald Trump about the 10% tariff baseline not being a future template is a clear signal of potential intent. Higher tariffs could significantly alter the landscape of international trade, bringing about notable economic impacts globally. For the cryptocurrency market reaction , this introduces another layer of macro-driven uncertainty, but also potentially reinforces narratives around decentralized assets as hedges against traditional economic and political risks. As these policy discussions evolve, monitoring their potential effects on market dynamics, including the specific interplay between Bitcoin and tariffs , will be essential for anyone involved in the digital asset space. The coming months could see these macro factors play an increasingly important role in shaping the crypto narrative and market movements. To learn more about the latest cryptocurrency market trends, explore our articles on key developments shaping Bitcoin price action and broader economic impacts.

Source: Bitcoin World