Crypto Market Reaction: Trump Signals Hope for Lower China Tariffs Amidst Crucial Trade Talks

5 min read

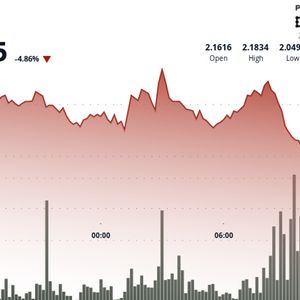

In the ever-watchful world of cryptocurrency markets, investors are always scanning the horizon for macroeconomic signals that could sway asset prices. One such significant signal recently emerged from Washington: President Donald Trump’s indication that existing China Tariffs Impact could be reduced if ongoing trade negotiations with Beijing prove successful. This isn’t just about soybeans or semiconductors; shifts in Global Trade Tensions have a ripple effect that reaches digital assets. Understanding the Context: The US-China Trade Deal Saga For several years, the relationship between the United States and China has been defined, in part, by a tit-for-tat tariff war. The U.S. imposed significant tariffs on billions of dollars worth of Chinese goods, citing unfair trade practices, intellectual property theft, and market access issues. China retaliated with its own tariffs on American products. This trade friction created considerable uncertainty for businesses globally, disrupted supply chains, and weighed on Market Sentiment . While trade talks have occurred intermittently, a comprehensive US-China Trade Deal has remained elusive. During a recent White House press conference, President Trump offered a glimpse of potential de-escalation. He stated: Tariffs currently in place could be lowered. This reduction is contingent upon a successful trade agreement being reached. He reiterated the U.S. desire for greater access for American companies and products within Chinese markets. This conditional offer injects a degree of optimism into the complex negotiations, suggesting a willingness from the U.S. side to use tariff reduction as a key incentive for China to meet U.S. demands. Why Do Global Trade Tensions Matter for Crypto? You might wonder, what do tariffs on Chinese goods have to do with Bitcoin or Ethereum? The connection lies in broader economic stability and investor behavior. Here’s how: Risk Appetite: When global trade tensions are high, it creates economic uncertainty. Investors tend to become risk-averse, moving capital away from potentially volatile assets (like stocks and sometimes crypto) towards safer havens (like gold or government bonds). Reduced tensions can increase risk appetite. Economic Growth: Trade wars can slow down global economic growth by increasing costs for businesses and consumers, reducing exports, and decreasing investment. A positive resolution could boost economic forecasts, which generally supports asset markets, including crypto. Currency Impact: Trade imbalances and tensions can affect currency values. While cryptocurrencies operate outside traditional forex, significant shifts in major fiat currencies can indirectly influence crypto trading pairs and overall market dynamics. Market Sentiment: News headlines about trade wars heavily influence overall Market Sentiment . Positive news, like the prospect of lower tariffs, can lead to a general bullish mood across financial markets, which often spills over into the crypto space. Conversely, negative news can trigger sell-offs. Therefore, monitoring developments in the US-China Trade Deal is crucial for anyone tracking the factors influencing the overall financial landscape and, by extension, the Crypto Market Reaction . Potential Upsides: What Lower China Tariffs Impact Could Bring Should the trade talks succeed and tariffs be significantly reduced or removed, several positive outcomes could materialize: Reduced Costs: American businesses importing goods from China would see lower costs, potentially leading to lower prices for consumers or increased profit margins. Boosted Exports: If China grants greater market access or reduces its retaliatory tariffs, U.S. exporters could see increased sales. Supply Chain Stability: Businesses could operate with greater certainty, making long-term planning and investment easier. Increased Investment: Reduced uncertainty could encourage both domestic and international investment. Improved Market Sentiment: A resolution would likely be met with enthusiasm by global financial markets, potentially driving asset prices higher. This positive sentiment often correlates with upward movement in the crypto market. A successful US-China Trade Deal leading to lower tariffs is generally viewed by economists and market analysts as a positive development for the global economy. Challenges and Uncertainties Facing the Trump Trade Deal Despite the glimmer of hope, significant hurdles remain in securing a comprehensive agreement: Complex Demands: The U.S. has sought structural changes in China’s economy, not just increased purchases of American goods. These demands (like intellectual property protection, state subsidies, forced technology transfer) are complex and difficult for China to agree to. Verification and Enforcement: Ensuring China adheres to any agreement is a major challenge, requiring robust verification and enforcement mechanisms. Political Considerations: Domestic politics in both countries can influence the negotiation process and willingness to compromise. Past Failures: Previous rounds of talks have broken down, highlighting the deep divisions and mistrust that exist. The path to a final US-China Trade Deal is fraught with potential pitfalls, and the outcome is far from guaranteed. This lingering uncertainty contributes to ongoing Global Trade Tensions and can keep markets volatile. Actionable Insights for Navigating the Market Impact For investors, particularly those in the cryptocurrency space, staying informed about these macroeconomic developments is key. Here are some actionable insights: Monitor Headlines: Pay attention to news regarding U.S.-China trade talks, tariff statements, and economic data releases from both countries. Assess Market Sentiment: Observe how traditional markets (stocks, bonds, commodities) react to trade news, as this often provides clues about overall investor confidence that can influence the Crypto Market Reaction . Understand Correlation vs. Causation: While crypto often reacts to macro news, its price is also driven by unique factors (adoption, technological developments, regulatory news). Don’t assume a direct, one-to-one correlation with every trade headline. Diversify: Don’t put all your eggs in one basket. Macro uncertainty underscores the importance of a diversified portfolio. Long-Term Perspective: Short-term market fluctuations driven by news cycles can be significant, but a long-term investment strategy focused on fundamentals often helps weather volatility. The potential for reduced China Tariffs Impact is a positive sign, but the journey to a final agreement is likely to involve more twists and turns, continuing to influence Global Trade Tensions and broader Market Sentiment . Conclusion: A Glimmer of Hope Amidst Lingering Global Trade Tensions President Trump’s recent comments suggesting a willingness to lower China tariffs upon the successful conclusion of trade talks offer a significant, albeit conditional, ray of hope. This development is closely watched by global markets, including the cryptocurrency space, where the Crypto Market Reaction is often tied to shifts in overall Market Sentiment and the resolution of major macroeconomic uncertainties like the US-China Trade Deal . While the prospect of reduced China Tariffs Impact is generally seen as bullish for the global economy and risk assets, the complexities of reaching a comprehensive agreement mean that Global Trade Tensions are unlikely to disappear overnight. Investors should remain vigilant, keeping an eye on negotiation progress and understanding how these macro forces can shape the investment landscape. To learn more about the latest global trade and market sentiment trends, explore our articles on key developments shaping the crypto market reaction and investment strategies.

Source: Bitcoin World