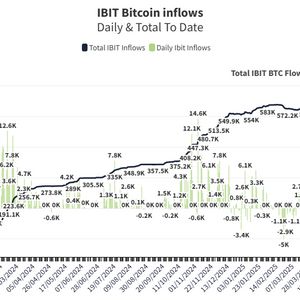

BlackRock’s iShares Bitcoin ETF Posts 18-Day Inflow Streak, Surpasses Gold ETF With Nearly $5 Billion

1 min read

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has recorded 18 consecutive days of inflows, accumulating nearly $5 billion in new investments since its launch over a year ago. This inflow streak places IBIT among the top 10 ETFs by inflows in 2025, surpassing the SPDR Gold Trust (GLD), which has seen $6.5 billion in inflows year-to-date. Despite the overall positive trend in Bitcoin ETFs, May 6 saw a net outflow of $85.7 million from Bitcoin ETFs and $17.9 million from Ethereum ETFs. On May 7, Bitcoin spot ETFs experienced a net inflow of $142 million, while Ethereum spot ETFs registered a net outflow of $21.77 million. Institutional activity remains notable, with some Ethereum withdrawals reported from exchanges like Binance and Kraken. Other Bitcoin ETFs such as Ark and Bitwise also reported inflows, with Ark seeing $54.7 million and Bitwise $10.5 million. Fidelity’s Bitcoin ETF showed inflows of $39.9 million on May 7 and $35.3 million on May 8, while BlackRock’s Bitcoin ETF posted inflows of $36.7 million and $37.2 million on May 6 and 7, respectively. Ethereum ETFs have generally experienced outflows during this period, including a $21.8 million outflow from BlackRock’s Ethereum ETF on May 7. Overall, Bitcoin ETFs have attracted more investor capital than Ethereum ETFs recently, highlighting a preference for Bitcoin among institutional investors. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant