BlackRock’s $11.6T Valuation Backs $5.4B Bitcoin Surge, IBIT ETF on 16-Day Inflow Streak

1 min read

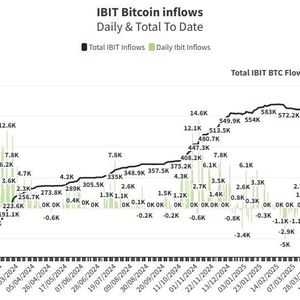

BlackRock Inc., with a market valuation of $11.6 trillion, has significantly increased its Bitcoin holdings, with its iShares Bitcoin Trust (IBIT) ETF purchasing over $5.4 billion worth of Bitcoin-related assets, according to a recent 13F filing. The firm’s aggressive accumulation continued last week, with IBIT acquiring $2.5 billion worth of Bitcoin, averaging $500 million daily. On May 2, IBIT alone saw a substantial inflow of $674.91 million, while other Bitcoin ETFs recorded no inflows, highlighting BlackRock’s dominant position in the Bitcoin ETF market. The firm’s ETF has been on a 16-day inflow streak, adding a total of $4.6 billion during this period, with 47,064 BTC purchased since April 21. To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant