BlackRock’s BUIDL Fund Puts $2.7B on Ethereum as Stablecoins Hold 0.5% of US Debt, Solana Hits $13.1B

1 min read

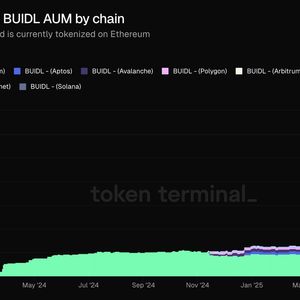

BlackRock’s BUIDL fund has allocated approximately $2.7 billion, or 92% of its assets, to the Ethereum blockchain, making Ethereum the dominant platform for the fund’s tokenized assets. Other blockchains with significant allocations include Aptos ($53.4 million), Avalanche ($52.8 million), Polygon ($38.4 million), Arbitrum ($32.5 million), Optimism ($26.2 million), and Solana ($20.1 million). In recent weeks, BlackRock has issued more of its USD stablecoin on Ethereum than the total amount it has issued across all other networks combined, underscoring a strategic focus on Ethereum for digital asset tokenization. To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant