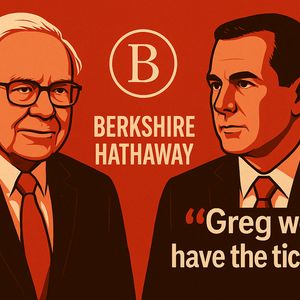

Buffet to step down

2 min read

Key Points: Buffett officially recommends Greg Abel take over as CEO , saying “Greg would have the tickets,” while he remains in a supporting role. He warned about the U.S. fiscal deficit , calling it “unsustainable” and highlighting the threat it poses to long-term stability. Despite concerns, Buffett remains optimistic , saying the U.S. is still the best place for investment and praising capitalism’s success. Buffett, who chaired his 60th shareholder meeting for Berkshire Hathaway, shared views on everything from investment strategy to global trade. He emphasized that balanced trade is essential and that the U.S. must remain connected to the world economically. Despite market turbulence and political challenges, he noted, “I would not get discouraged.” Reflecting on America’s economic power, Buffett called himself lucky for being born in the U.S. and stressed the strength and resilience the country has shown through wars, recessions, and historic developments. On investing, he revealed Berkshire nearly spent $10 billion recently and is open to spending even more when the right opportunity arises, admitting, “We’re running a business which is very, very, very opportunistic.” He contrasted this with real estate, which he finds slow and less attractive due to complex ownership issues and long negotiations. Buffett also touched on the U.S. energy grid, saying major improvements are needed and comparing the situation to the urgency and innovation seen during World War II. He believes Berkshire’s unique capital and know-how can help reshape it. Regarding market behavior, Buffett downplayed recent volatility, advising investors to keep emotions in check and remember that building wealth doesn’t require taking unnecessary risks: “You only have to get rich once.” On global currencies, he cautioned against owning assets tied to devaluing currencies and hinted at future foreign investments being financed locally. Closing the session, Buffett reaffirmed his belief in capitalism’s success despite its flaws , acknowledging that while it’s produced unmatched prosperity, it also carries the risks of turning into a “massive casino.”

Source: Coinpaprika