Following Today’s US Economic Data, a Dovish Fed is Expected: How Could This Affect Bitcoin Price?

2 min read

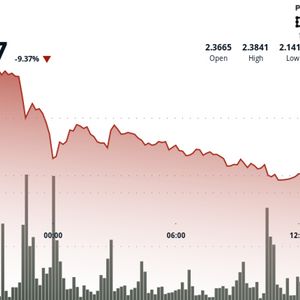

Mixed U.S. economic data is fueling speculation that the Federal Reserve could adopt a more dovish stance on interest rates, potentially providing support for Bitcoin and other risky assets, market analysts say. Several key U.S. macroeconomic indicators today painted a picture of stagnant growth and persistent inflationary pressures, adding to uncertainty in financial markets. The latest ADP report showed private sector job creation slowing significantly in April. Only 62,000 new jobs were added, well below expectations of 108,000 and well below March’s 147,000. At the same time, U.S. first-quarter GDP unexpectedly shrank by 0.3%, marking the first negative quarterly growth since 2022. Economists had forecast a modest 0.2% expansion. Meanwhile, inflation data from the Fed’s preferred indicator, the Personal Consumption Expenditures (PCE), presented a mixed picture. March PCE rose 2.3% annually, slightly ahead of expectations of 2.2%, while Core PCE, which excludes food and energy prices, came in at 2.6% annually, in line with expectations and down from February’s revised 3.0%. The combination of slow growth and steady inflation has revived talk of stagflation and led to speculation that the Fed may be forced to ease monetary policy sooner than expected. Related News: JUST IN: Important Listing News from Coinbase – One Has Been Long Awaited “Fed funds futures reflect the increasing likelihood of 4+ rate cuts this year as the Fed navigates clear signs of declining inflation and an economic slowdown,” David Hernandez, crypto investment expert at 21Shares, told The Verge. “This delicate balancing act will be at the core of market dynamics in the coming weeks.” Bitcoin briefly dropped below $94,000 after the economic data was released, falling 1% on the day. However, some analysts say lower interest rates and a softer U.S. dollar could pave the way for a new rally in cryptocurrency markets. “A weaker dollar, better liquidity from looser monetary policy, and lower Treasury yields present a more supportive macro backdrop for Bitcoin,” said Dr. Kirill Kretov, senior automation expert at CoinPanel. Kretov also noted that President Donald Trump’s increasing pressure on the Fed to cut interest rates, combined with easing tariff concerns and weak liquidity in crypto markets, could amplify the impact of any dovish policy changes. “A dovish shift looks even more likely when we factor in the surprise -0.3% GDP print,” Kretov said. “Even modest inflows could send BTC sharply higher. This market is poised for upside but is also extremely sensitive to macro changes.” *This is not investment advice. Continue Reading: Following Today’s US Economic Data, a Dovish Fed is Expected: How Could This Affect Bitcoin Price?

Source: BitcoinSistemi