BlackRock’s Tokenized Treasury Fund Grows Sevenfold to $2.5B; Six Entities Control 88% of $5.4B Market

1 min read

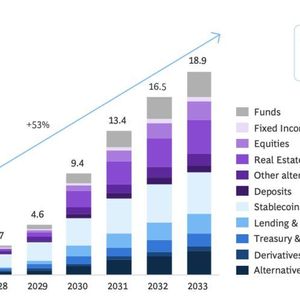

The market for tokenized real-world assets, including U.S. Treasuries and real estate, is expanding, with major financial institutions leading the growth. BlackRock’s U.S. Treasury tokenized fund has grown sevenfold over the past year to $2.5 billion, paying $4.17 million in March dividends and now operating on seven blockchain networks. Six entities control 88% of the $5.4 billion tokenized treasury market, including benji ($707 million), ustb ($661 million), usdy ($586 million), usyc ($487 million), and ousg ($424 million). A recent Deloitte report projects the global tokenized real estate market will increase from less than $300 billion in 2024 to $4 trillion by 2035, with a 27% annual growth rate. The report notes significant expansion in tokenized private real estate funds, securitized loans, and development projects, enabled by blockchain technology for programmable and customizable ownership. To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant