Bitcoin Futures and Options Open Interest Surge to $38.6B and $30.7B Amid $104M Short Liquidations

1 min read

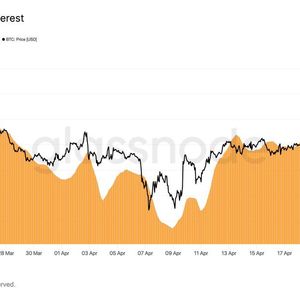

Bitcoin’s derivatives market has experienced a notable surge in open interest and trading activity, signaling increased trader confidence and bullish sentiment. Bitcoin futures open interest rose from $36.2 billion on April 21 to $38.6 billion on April 22, marking a $2.4 billion increase and the highest level since late March. Similarly, Bitcoin options open interest jumped by $2.2 billion in 24 hours to $30.7 billion, also the highest since March. The total derivatives volume exceeded $130 billion, with open interest surpassing $65 billion. This surge in derivatives activity has contributed to short squeezes affecting hedge funds, with $104 million in short positions liquidated within 24 hours. The market shows a slight long bias, reflecting renewed retail investor enthusiasm and aggressive positioning in the derivatives market, reminiscent of bullish phases seen in late 2024. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant