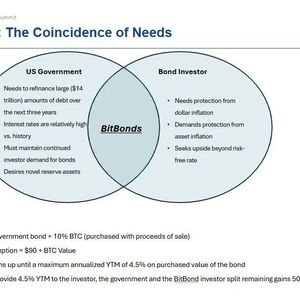

VanEck Proposes BitBonds: 90% Treasury, 10% BTC to Refinance $14 Trillion U.S. Debt Over 3 Years

1 min read

VanEck has proposed a new financial instrument called ‘BitBonds’ to help the U.S. refinance its $14 trillion national debt over the next three years. The proposal aims to provide investors with inflation protection by linking Treasury bonds to Bitcoin. The structure of BitBonds includes a 90% allocation to Treasury securities and a 10% allocation to Bitcoin, allowing for full Bitcoin upside until a 4.5% annual return is reached. After that threshold, the upside will be split 50/50 between Bitcoin and Treasury returns. This initiative is seen as a solution to align the interests of investors with the need for government financing. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant