VanEck Proposes $110 Billion BitBonds With 10% Bitcoin to Refinance $14 Trillion U.S. Debt

1 min read

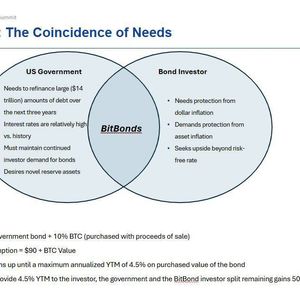

VanEck, a $110 billion asset manager, has proposed the introduction of “BitBonds,” a hybrid debt instrument designed to help the U.S. government refinance its $14 trillion debt over the next three years. The BitBonds would be structured as 10-year U.S. Treasury bonds with 90% exposure to traditional Treasuries and 10% exposure to Bitcoin, funded by bond sale proceeds. At maturity, investors would receive the full value of the Treasury portion plus the value of the Bitcoin allocation. To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io

Source: The Defiant