Shocking Missed Opportunity: ETH Whale’s $27 Million Loss After 900-Day Hold

5 min read

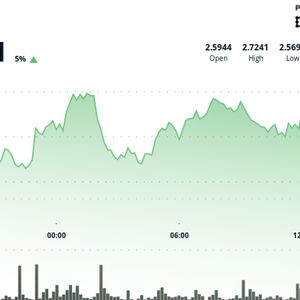

In the volatile world of cryptocurrency, even seasoned investors can face the bittersweet sting of ‘what if.’ Recently, an ETH whale , a term used for individuals or entities holding large amounts of Ethereum, provided a stark example. After patiently holding a substantial 10,000 ETH stake for over 900 days, this whale decided to cash out, securing a healthy profit. However, the timing of their exit left a significant amount of potential gains on the table – a staggering $27 million to be precise. Let’s dive into this fascinating case and explore what we can learn from this Ethereum whale’s trading decision. Decoding the Whale’s Ethereum Trade: A Timeline To understand the full picture, let’s break down the timeline of this intriguing whale trades : Acquisition Phase (Late 2022): The ETH whale strategically accumulated 10,000 ETH. The total investment at this stage amounted to $12.95 million. This suggests a calculated entry into the Ethereum market, likely anticipating future growth. Holding Period (900+ Days): For over two and a half years, the whale remained steadfast, holding onto their significant ETH stake. This period encompassed considerable market fluctuations, including peaks and troughs in Ethereum’s price. Sale Execution (April 8th): The whale decided to liquidate their entire 10,000 ETH holding. The sale was executed at an average price that resulted in a total of $15.71 million. Profit Realization: The difference between the sale proceeds ($15.71 million) and the initial investment ($12.95 million) resulted in a $2.75 million profit for the whale. A substantial return in traditional investment terms. The Missed Opportunity: Here’s where the ‘what if’ scenario comes into play. During the whale’s holding period, Ethereum reached a peak price of around $4,000. Had the whale sold at this peak, their 10,000 ETH would have been worth approximately $43.3 million. This means by selling on April 8th, the whale missed gains of a potential $27.6 million ($43.3 million potential peak value – $15.71 million actual sale value). This significant difference highlights the inherent challenge of timing the market, even for sophisticated investors. Why Did the Whale Sell and Miss Out on Potential Crypto Gains? The million-dollar question (or rather, the $27 million question) is: why did this ETH whale sell when they did, especially considering the much higher peak Ethereum had reached previously? There could be several reasons, and it’s important to remember we can only speculate based on publicly available data: Profit Targets and Risk Management: The whale might have had pre-defined profit targets. A $2.75 million profit on a $12.95 million investment is a significant return. Perhaps the whale’s strategy focused on securing substantial gains rather than aiming for the absolute market top, which is notoriously difficult to predict. Risk management could also have played a role. After 900 days, the whale might have felt it was time to de-risk and secure profits, especially given the inherent volatility of the crypto market. Market Outlook Change: The whale’s perspective on the future of Ethereum or the broader crypto market might have shifted. Perhaps they anticipated a potential downturn or believed that other investment opportunities offered better risk-adjusted returns at that moment. Personal Financial Needs: External factors, such as personal financial needs, could have prompted the sale. Whales, despite their large holdings, are still individuals or entities with real-world financial requirements. Strategic Portfolio Rebalancing: The sale could have been part of a broader portfolio rebalancing strategy. The whale might have decided to allocate capital to other asset classes or cryptocurrencies, diversifying their holdings and reducing concentration risk in Ethereum. Simply Satisfied with Profit: It’s also possible the whale was simply content with the $2.75 million profit. Not everyone aims for maximum possible gains. Securing a significant return and moving on is a valid investment strategy. Lessons Learned from This Whale’s Market Timing This Ethereum whale’s transaction provides valuable insights for anyone involved in cryptocurrency trading, regardless of their portfolio size. Here are some key takeaways: Market Timing is Exceptionally Difficult: Even with a long-term holding strategy and significant market knowledge, perfectly timing the market top is incredibly challenging. The whale held through substantial volatility but still missed the absolute peak. This reinforces the adage, “time in the market” often outperforms “timing the market.” Profit is Still Profit: While the missed potential gain is eye-catching, it’s crucial to acknowledge that the whale still secured a $2.75 million profit. Focusing solely on missed opportunities can lead to regret and potentially impulsive decisions. Celebrating realized profits is important for maintaining a balanced investment mindset. Have a Clear Investment Strategy: Whether it’s setting profit targets, defining risk tolerance, or having a long-term outlook, a well-defined investment strategy is crucial. This strategy should guide your decisions and prevent emotional reactions driven by market fluctuations. Volatility is Inherent in Crypto: The crypto market is known for its volatility. Prices can swing dramatically in short periods. This case highlights both the potential for massive gains and the risk of missing out on peaks. Investors must be prepared for this volatility and manage their risk accordingly. Focus on Long-Term Value: While short-term price movements are captivating, focusing on the long-term value proposition of your investments is often more rewarding. Understanding the fundamentals of projects like Ethereum and believing in their future potential can lead to more rational and less emotionally driven trading decisions. Analyzing Crypto Gains and Losses: It’s All Relative The story of this whale trades serves as a powerful reminder in the often-unpredictable world of crypto. While the $27 million missed gains figure is indeed shocking and makes for a compelling headline, it’s essential to contextualize the situation. The whale still walked away with a substantial profit. In the grand scheme of crypto gains and losses, this event underscores the human element in trading – the mix of strategy, emotion, and sometimes, just plain luck. For everyday crypto enthusiasts, the lesson is clear: aim for informed decisions, have a strategy, and remember that in the crypto market, volatility is the name of the game. Don’t let the allure of perfect timing or the sting of missed peaks overshadow the importance of consistent, well-thought-out investment practices. To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum price action.

Source: Bitcoin World