Ethereum: Still Bullish At $4K, But These Altcoins Might Outperform In 2025

7 min read

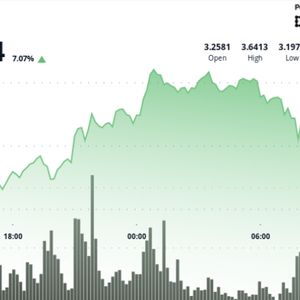

Summary Ethereum’s underperformance in 2024, despite bullish developments, leads me to favor altcoins like Algorand, Filecoin, Flow, Hedera, Solana, and Stellar for 2025. Altcoins are gaining market share and could benefit significantly from deregulation, potential ETF approvals, and proposed tax changes under the incoming Trump administration. I’m reallocating profits from Bitcoin and Ethereum into promising altcoins, but caution is advised due to their higher risk and centralized nature. Altcoin season in 2025 could offer substantial gains, but investors should only allocate a portion of their portfolio they’re willing to lose. Thesis While Ethereum USD ( ETH-USD ) could still reach higher highs after passing the $4,000 mark, other altcoins have more tailwinds that might allow them to outperform Ethereum with bigger gains in 2025. Specifically, I’m looking at Algorand ( ALGO-USD ), FileCoin ( FIL-USD ), Flow ( FLOW-USD ), Hedera ( HBAR-USD ), Solana ( SOL-USD ), and Stellar ( XLM-USD ). The State of Ethereum at $4,000 At first glance, Ethereum investors don’t have much to complain about in 2024. The token’s price in USD nearly doubled, and is close to its all-time high at over $4,000. However, Ethereum has been an underperformer relative to many other cryptocurrencies; its year-to-date returns lag behind those of the next 10 largest cryptocurrencies (including Bitcoin). This is despite Ethereum seeing many bullish developments in 2024 including spot ETF approval and the Dencun upgrade landing. While I started 2024 a bit more bullish on Ethereum than Bitcoin ( BTC-USD ), I’m now a bit more bullish on Bitcoin than Ethereum, and also view quite a few altcoins as better investments than Ethereum in 2025. That said, I am still bullish on Ethereum as well. The main reason for my changing viewpoint is Ethereum’s relative lack of market fit in the leading use cases for cryptocurrency. As a store of value, it’s being outperformed by Bitcoin, which has a first mover advantage and more predictable supply rules. Multiple nations are considering establishing strategic reserves of Bitcoin, but there’s not much news about Ethereum strategic reserves. There’s an argument that Ethereum’s staking rewards and more energy-efficient consensus mechanism would allow it to function as an effective store of value as well, but that thesis isn’t showing any signs of playing out right now. As a speculative investment, Ethereum is now quite large as the world’s 26th most valuable asset. While I won’t completely discount the possibility that Ethereum can still return 10x or more from here, it’s undeniable that smaller cryptocurrencies have more total return potential for investors who can tolerate their extremely high risk. Lastly, as a utility token for emerging use cases like cross-border transactions and tokenized assets, other altcoins simply work better. Ethereum’s focus on security and decentralization at the expense of scalability and simplicity is killing it here, as it allows other cryptocurrencies to be faster, cheaper, and simpler. Financial companies using cryptocurrency like Visa have started integrating with some of these alternatives, such as Solana and Stellar. Security and decentralization do matter, but for many end users they seem to be less important than other factors like cost and speed. Of course, Ethereum still has one of the most active cryptocurrency developer communities, and it’s still the second largest/most established cryptocurrency by a mile. For these reasons, I’m still bullish on Ethereum overall. However, I’ll spend the rest of this article looking at why I’m more bullish on other cryptocurrencies going into 2025. Altcoin Tailwinds Bitcoin dominance chart ( CoinMarketCap ) The above chart shows the market share of Bitcoin and Ethereum in the cryptocurrency industry over time. It shows that in 2017 and 2021, altcoins besides Bitcoin and Ethereum gained substantial market share. If this pattern repeats once again after another four years, early 2025 could be a great time to be invested in altcoins. In fact, altcoins have already been meaningfully outperforming over the past month, with their combined market share jumping from 27% to 33%. Of course, just because something happened in 2017 and 2021 doesn’t guarantee that it will happen in 2025. I’m not one to bet everything on “chart magic” like technical analysis. But there are many fundamental reasons why altcoins are well-positioned at this point in time. Let’s take a look at a few of them. Deregulating As I wrote last week, the incoming Trump administration has taken a pro-crypto stance that includes easing up on cryptocurrency regulation. Trump has already set in motion the replacement of SEC chair Gary Gensler with pro-crypto former chair Paul Atkins. When announcing this appointment, Trump explicitly called out cryptocurrencies, stating that Atkins “recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before.” While this appointment could undoubtedly benefit Bitcoin and Ethereum, altcoins should benefit even more. Gensler, the current chair, brought many lawsuits against smaller cryptocurrencies, including a claim that cryptocurrencies like Ripple ( XRP-USD ), Solana, and Cardano ( ADA-USD ) are unregistered securities. These lawsuits threaten to delist these tokens from crypto exchanges like Coinbase and impose a variety of other restrictions. More generally, semi-centralized cryptocurrencies like the aforementioned ones currently lack a clear regulatory classification from the SEC, and that could be fixed within the next four years. If the SEC’s lawsuits against Coinbase were to go away, the cryptocurrencies directly involved in them would be positioned to benefit most. That includes: Solana Cardano Polygon ( MATIC-USD ) FileCoin Sandbox ( SAND-USD ) Axie Infinity ( AXS-USD ) Flow Internet Computer ( ICP-USD ) Near ( NEAR-USD ) Meanwhile, Bitcoin and Ethereum were left out of these lawsuits, and even Gensler had stated that Bitcoin is a commodity. As such, these two tokens are unlikely to benefit much from a changed approach at the SEC. ETFs Bitcoin and Ethereum are currently the only two cryptocurrencies with approved spot ETFs. Both of these cryptocurrencies already saw significant price appreciation after their respective ETF approvals, and it’s likely that any other cryptocurrency that got an ETF approved would see similar price appreciation in the future (since it would become more accessible to investors). However, attempts to create ETFs for other cryptocurrencies have been rejected by the SEC so far. The approval for BTC/ETH ETFs was largely based on these cryptos having active futures markets, including futures ETFs. No other cryptocurrency has this. But it’s possible that the incoming administration will take a looser regulatory approach and allow ETFs for cryptocurrencies that don’t have futures ETFs. This would benefit virtually all cryptocurrencies that are large enough to be worth creating an ETF for. It’s worth noting that Ethereum ETFs don’t currently support staking, and that could also change under the incoming administration, benefitting Ethereum. Tax Changes It’s been reported and tweeted that Trump’s team is considering eliminating capital gains taxes on cryptocurrencies issued by USA companies, allowing investors to realize gains on these cryptocurrencies tax-free and making the USA the “crypto capital of the world.” From my perspective, eliminating capital gains taxes on crypto makes a lot of sense. The original vision for cryptocurrencies was a peer-to-peer online payment mechanism, but using cryptocurrency in this way is very impractical today. Law-abiding users have to track every crypto payment they make in order to pay taxes on their (potentially minuscule) gains and losses. Eliminating capital gains taxes on cryptocurrencies would solve this problem, while also significantly benefitting cryptocurrency investors. However, I don’t think it makes much sense to limit this benefit to cryptocurrencies issued by USA companies, which are by definition more centralized than cryptocurrencies with no issuer. For better or for worse, neither Bitcoin nor Ethereum is issued by a USA company. Cryptocurrencies that would benefit include: XRP ( XRP-USD ) Solana Cardano Avalanche ( AVAX-USD ) ChainLink ( LINK-USD ) Stellar Hedera FileCoin Algorand Flow Which Altcoins Are Best For 2025? Although the new Trump administration hasn’t officially begun, markets seem to be taking their crypto proposals seriously. Many of the cryptocurrencies listed as beneficiaries in the previous sections – namely XRP, Cardano, Stellar, Algorand, and Hedera – have been the best performers out of the top 50 cryptocurrencies (including Bitcoin and Ethereum) since the election. Some of these coins are up 200% or more since early November, but I believe that there’s room for further appreciation. We’re still in the “buy the rumor” phase of the aforementioned policy changes, and alt-coins overall are still fairly far from the ~50% market share they achieved near the end of past cycles. While I’m not adding much new money to cryptocurrency right now, I am moving some of my profits from Bitcoin and Ethereum into the aforementioned coins. I’m splitting this distribution between coins that are positioned to benefit from upcoming policy changes but haven’t appreciated too much yet (FileCoin, Flow, Solana) and coins that are currently leading in this cycle (Algorand, Hedera, Stellar). Besides regulatory considerations, these coins (and Ethereum) have seen real-world adoption by large companies including the Visa, Mastercard, Stripe, Franklin Templeton, the NFL, the NBA, and others. Regardless of the regulatory environment, I believe that this type of adoption is likely to increase as cryptocurrency gains utility and mainstream acceptance. I wrote more about this topic in my recently published book, Decoding Cryptocurrency . That said, buying anything that’s appreciated quickly in a short amount of time is risky, and most of these coins don’t benefit from the same scarce supply rules that Bitcoin and Ethereum have. After all, unlike Bitcoin and Ethereum, many of these cryptocurrencies are somewhat centralized and are issued by companies that need to sell their holdings for funding. As a result, I’m looking at this positioning as more of a short-term trade, and will likely scale out of these riskier holdings throughout 2025. Conclusion If previous patterns hold, 2025 will mark the peak of the current 4-year crypto cycle, and we’ll see an “altcoin season” where many smaller cryptocurrencies temporarily experience faster price appreciation than Bitcoin and Ethereum. While I view altcoins as very risky investments, the shifting regulatory environment is providing fundamental tailwinds to reinforce their price appreciation. As such, I think it’s reasonable for investors to allocate a portion of their portfolio that they’re willing to lose to altcoins.

Source: Seeking Alpha